Primer on Carbon Finance (2/3): Pricing Future Carbon Streams

Reading Time: 15min

From our three-part Carbon Finance Series, this article dives into Carbon Pricing. Check out Part #1 setting the stage of Carbon Project Financing and Part #3 Getting Your Project Funding-Ready.

Defining the price of carbon credits, especially those for future delivery, is a critical exercise for project developers.

Unlike a simple commodity, carbon credits carry nuanced value based on their origin, impact, and market demand.

This article is devided in two parts:

A. How to Determine the Price of Carbon Credits

B. Embedding Pricing scenari into Carbon Finance agreements.

A. How to Determine the Price of Carbon Credits

The price of a carbon credit – representing one tonne of carbon dioxide equivalent (tCO2e) reduced or removed from the atmosphere – is determined by a complex interplay of factors, not just a single driver or principle.

Overall, price discovery in the Voluntary Carbon Market remains opaque and unorganized, making it difficult to track reliable average prices or compare across methodologies. We can however still identify different dynamics.

1. Market Dynamics (Supply & Demand)

This is the most visible and immediate driver of carbon credit prices, particularly in voluntary carbon markets.

Demand

Demand is usually driven by companies or individuals seeking to offset their unavoidable emissions, meet corporate ESG goals, respond to stakeholder pressure, or even prepare for potential future regulations.

It is usually influenced by several interrelated factors :

Net-Zero Targets: as more companies commit to net-zero, their demand for credible offsets rises for compensating residual emissions

Reputational Risk: companies increasingly realize the reputational damage of not addressing their carbon footprint—often driven by public scrutiny, activist investor campaigns, and growing consumer expectations.

Regulatory Foresight: some companies purchase credits / allowances to meet existing compliance obligations (like the ETS) while others proactively do so, anticipating future compliance obligations or carbon taxes.

Quality Differentiation & Preferences: buyers increasingly distinguish between "cheap" credits and "high-integrity" credits, willing to pay more for projects with strong environmental and social co-benefits and robust MRV.

Labels & Ratings: specialized due diligence and risk ratings agences have emerge to assess the quality of credits. Labels from integrity initiatives such as ICVCM CCP Labels are also providing guidance to buyers to define and recognize high-quality credits among the overall supply.

Carbon Insurance: carbon credit issuance have emerged in the past years in an attempt to provide additional assurance for buyers especially institutional ones which tend to be risk-averse. Carbon insurance such as Kita, Oka, Cfc, CarbonPool offer policies to cover against various risks like non-delivery, invalidation, or reversal of carbon credits. While they come with a cost, insurance contracts also justify a price premium on carbon credits.

Supply

Supply: comes from projects that successfully reduce or remove emissions and have those reductions verified and issued as credits by recognized standards.

However, supply is limited and often slow to respond to changes in price, largely due to a range of structural and technical barriers, such as:

Project Development Costs: the expense of designing, implementing, monitoring, and verifying projects. From feasibility studies and baseline assessments to long-term monitoring and third-party verification, the upfront and ongoing costs of project development can be substantial—especially in the Global South or remote regions.

Technological Maturity: more mature, scalable technologies can often generate credits more affordably than nascent approaches .

Policy Support: government incentives or clear regulatory frameworks can positively influence project development. In contrast, regulatory uncertainty or weak enforcement can discourage investment.

Time to Market: the long lead times between project development to credit issuance can restrict immediate supply and thus market responsiveness to growing demands

Challenges with market dynamics alone

Pure market forces, while efficient in some ways, often fail to reflect the true societal cost of carbon or the full value of projects.

This can lead to low prices that don't incentivize the most impactful or highest-cost abatement projects, and a focus on "low-integrity credits" (leading to perverse incentives) rather than "quality impacts."

2. Cost-Based Pricing (e.g., Fairtrade Minimum Pricing Model + Premium)

This approach attempts to ensure that project developers receive a price that covers their costs of operation and provides a fair return, regardless of immediate market fluctuations.

Concept: Similar to Fairtrade principles for agricultural products, a minimum price is set that covers the average production costs of the carbon credit, plus an additional premium.

It defines a minimum price per tonne for specific project types (e.g., clean cookstoves, renewable energy, forest management) that aims to cover the project's direct costs, MRV, and a baseline for sustainable operation.

An additional "Fairtrade Premium" might be added on top, specifically allocated to community development, resilience-building, or other sustainable development co-benefits beyond just carbon.

3. Value-Based Pricing

This approach seeks to internalize the broader benefits and costs associated with carbon emissions and abatement, moving beyond just the direct cost of reduction or removal. This is where the concept of "cost for society" comes in.

Concept

A carbon credit's price should reflect not only the cost of avoiding or removing a tonne of CO2e but also the avoided damages that tonne would have caused, and the additional positive impacts the project delivers on the environment, health, and a range of other indicators.

This concept is sometimes associated with the notion of "Cost for Society" or the “Social Cost of Carbon” (SCC).

The U.S. EPA calculated the Social Cost of Greenhouse Gases (SC-GHG) at $190 per tonne of CO2 as of Feb 2023. This figure is derived from complex integrated assessment models that project future climate damages (sea-level rise, agricultural impacts, health effects, extreme weather events) and discount them back to present value.

Implication for Carbon Credits

In theory, if a carbon credit truly offsets a tonne of CO2, its price should at least reflect the SCC, as it represents the avoided societal damage. If credits are priced significantly below the SCC, society is still implicitly paying a hidden cost for the continued emissions.

While this sounds rational in practice, it is mostly not implemented due to the fact that pollution remains “free” in most parts of the world.

Price Range Estimations

Given these diverse approaches, carbon credit prices can vary wildly:

Low-cost credits (e.g., some older avoided deforestation projects, large-scale renewables): can range from $3-$15 per tonne, often driven by high supply and lower perceived co-benefits or older methodologies.

Mid-range credits (e.g., clean cookstoves, some improved forest management, soil carbon): often command $15-$40+ per tonne, reflecting stronger co-benefits and more robust MRV.

High-quality removal credits (e.g., certified biochar, direct air capture with storage): can fetch $100-$800+ per tonne, due to higher abatement costs, permanence, and often significant investment in advanced technology.

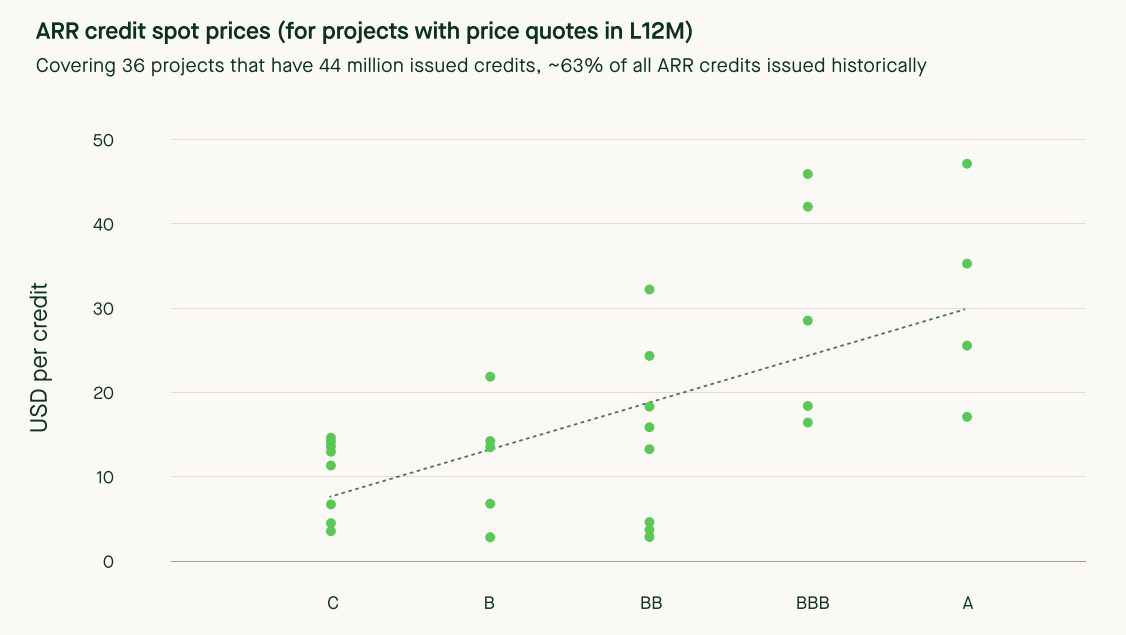

Source: Abatable, 2024

Redefining Quality for price Premiums

The landscape of carbon credits has evolved significantly, with emerging frameworks, standards, and policies redefining what constitutes quality.

These new benchmarks are setting a higher bar for the types of projects companies can support and the claims they can credibly make, directly influencing and often explaining the premium prices seen for "high-quality" carbon credits.

Demand-Side Carbon Credit Integrity Frameworks

Oxford Principles for Net Zero Aligned Carbon Offsetting: These principles guide high-quality carbon offsetting towards net-zero alignment by advocating for a shift from avoidance to durable carbon removals and long-term storage.

EU Green Claims Directive and CRCF: These EU initiatives aim to combat greenwashing by requiring substantiation of environmental claims and certifying high-quality carbon removal activities to ensure integrity and trustworthiness.

SBTI Net Zero framework: this framework provides a science-based pathway for companies to set credible net-zero targets by prioritizing deep decarbonization within their value chains before considering the use of high-quality carbon credits for residual emissions.

VCMI Code of Practice: this code offers clear guidance for companies on making credible claims about their use of carbon credits, linking such claims to their overall decarbonization progress to ensure integrity and prevent greenwashing.

Supply-Side Carbon Credit Quality Assurance

CORSIA eligibility: These criteria define the specific requirements for carbon credits to be used by international airlines for offsetting emissions above a baseline, emphasizing additionality, permanence, robust quantification, and host country authorization to prevent double counting.

ICVCM’s Core Carbon Principles (CCP): The CCPs establish a global baseline for high-integrity carbon credits, ensuring quality, transparency, and real-world impact across the voluntary carbon market.

Credit ratings: companies like Sylverra, BeZero, Renoster, Calyx, AlliedOffsets independently assess the quality and integrity of carbon offset projects and the credits they generate. They aim to provide transparency and reduce risk for buyers by evaluating factors like additionality (whether the emission reduction would have happened anyway), permanence (how long the carbon remains removed or avoided), and accuracy of quantification.

According to Sylvera’s State of Carbon Credits 2024 report, buyers typically pay about $5 more for higher-rated Reforestation projects:

Defining Carbon Credit Pricing projections for your Project

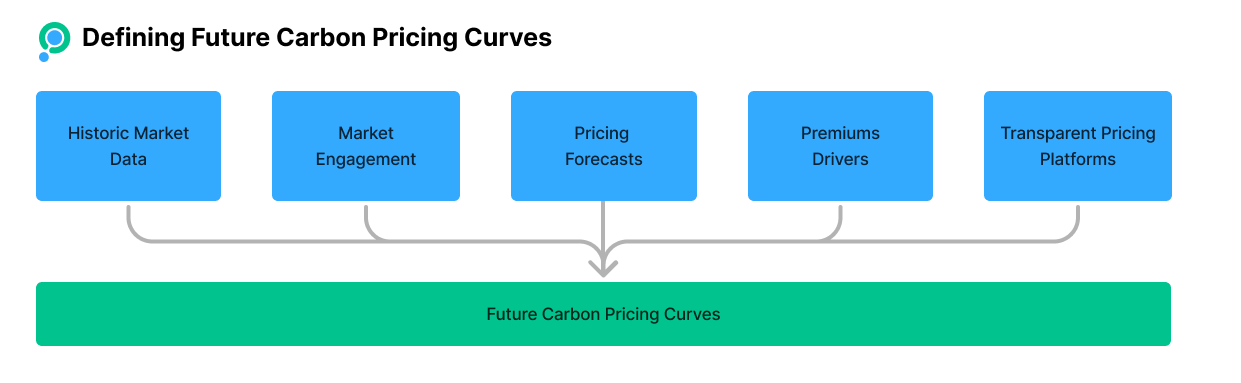

Here's how project developers can approach this complex task:

1. Analyzing Historical Market Data

Study Past Transactions: examine historical prices for similar project types, methodologies, vintages, and co-benefits. This helps set realistic expectations.

Identify Trends and Volatility: understand past price fluctuations to gauge market stability for your specific project segment. This needs to be analyzed cautiously because past movements are not always guaranteed to explain future trends.

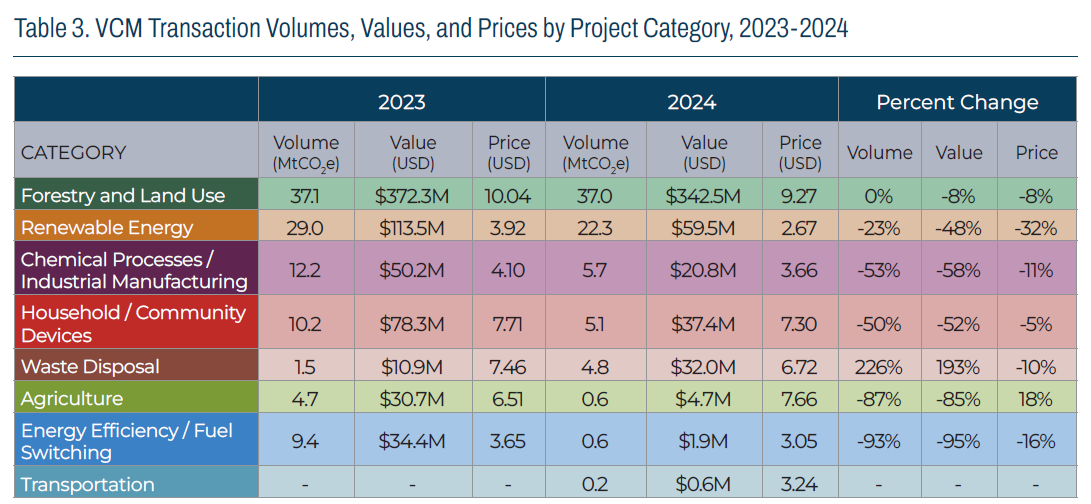

For example, Ecosystem Marketplace publishes yearly studies on the Voluntary Carbon Market and reported average transaction price of carbon credits of $6.37 in 2024, more than double the 2020 average price (State of the VCM 2025). This usually does not include advanced permanent removals which can go well beyond $100 per credit.

Source: Ecosystem Marketplace, 2025

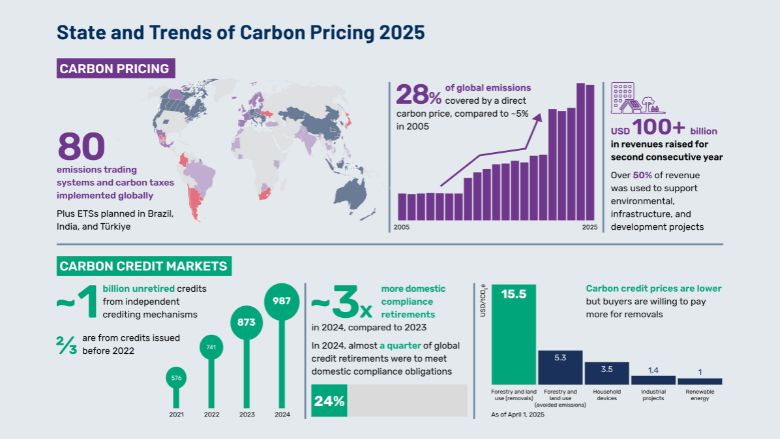

The World Bank recently published State and Trends of Carbon Pricing 2025.

2. Engaging with Buyers and Market Communities:

Direct Conversations: talk to potential buyers to understand their specific needs, price sensitivities, and long-term purchasing strategies. Engage with peers to learn from previous experiences.

Market Consultations: participate in industry forums and events to gain insights into emerging trends and buyer demands.

Expert Opinions: consult carbon market analysts for insights into market sentiment and anticipated price movements.

Buyer Surveys/RFPs: respond to requests for proposals or participate in surveys from market research firms for direct pricing indications.

Understand Buyer Motivations: some buyers are most cost sensitive, while others seek high-integrity projects with significant co-benefits, willing to pay a premium.

3. Incorporating Forecast Data and Future Dynamics:

Supply & Demand Projections: analyze forecasts for future carbon credit supply and demand, influenced by corporate net-zero commitments and regulatory shifts.

Regulatory Landscape: anticipate the impact of evolving climate policies on market prices and country specific mandates. For example, the emergence of compliance markets which allow the use of voluntary carbon credits can indicate potential pricing uptrend.

Technological Advancements: consider how new technologies might affect credit costs and supply.

AlliedOffset publishes regular market forecasts, the latest for 2025 published in March indicates prices reaching $35 by 2030 (2025 Forecast Report).

Voluntary Carbon Market forecast by scenario:

Source: AlliedOffsets, 2025

4. Pricing premium value

Co-Benefits Valuation: quantify and highlight additional values like job creation or biodiversity, as buyers increasingly pay premiums for these.

Price Premium Driver: justify higher prices for projects with robust methodologies, strong verification, clear additionality, and significant co-benefits. Understand how labels (Corsia eligibility, CCP label), may justify higher prices.

5. Scouting for transparent Pricing Mechanisms and Platforms

Reverse Auctions: platforms where buyers bid down the price they're willing to pay for a set quantity of credits, or sellers bid down the price they're willing to accept. Sweden has used it for BECCS, and so did Saudi’s RVCMC to auction Kenya’s voluntary credits.

Hybrid Compliance Markets: carbon schemes like CORSIA for aviation offsetting or Singapore’s carbon tax use international voluntary credits, which are now being purchased through organized market events offering transparent price signals. In 2025 the International Air Transport Association (IATA) organized a fixed-price procurement event with 32 participating airlines for CORSIA eligible credits.

Blockchain-Based Pools: decentralized platforms (e.g., Toucan Protocol's Carbon Pool Char) are trying to aggregate and standardize carbon credits, allowing for more transparent and efficient price discovery.

Carbon Indexes: Publicly available financial indexes (like Puro’s CORC Carbon Removal Index) that track and report average prices for specific types of carbon credits, offering real-time market benchmarks.

Beyond these basics, the carbon market also includes complex financial tools like futures and swaps which help establish prices but won't be covered in this article.

Useful pricing resources

Ecosystem Marketplace Reports

S&P Platts Carbon Credit Assessments

MSCI Trove Research

ClearBlue Markets Vanguard Platform

Abatable’s Platform

AlliedOffsets’ platform and price indexes

Quantum Intelligence’s Price Assessments

World Bank’s 2025 carbon pricing report

B. Embedding Pricing scenari into Carbon Finance agreements

For both project developers and investors, weaving specific pricing scenarios into carbon finance agreements is essential for managing risk and achieving financial and climate goals.

1. Fixed Price

This strategy locks in a set price today for future carbon credit deliveries. It often leverages agreed price forecast models that account for trends like inflation, or anticipates a downtrend due to economies of scale. For instance, if Direct Air Capture (DAC) credits are seen at $800+ today, a fixed price might be set much lower for future deliveries, reflecting expected technological maturity and cost reductions. A Fixed price provides price certainty for buyers and revenue predictability for developers.

2. Variable Price (Market-Linked)

Here, the future price is dynamic, fluctuating with a pre-defined market price signal or index. An example could be tying credit prices to the NASDAQ Biochar Index. This approach offers flexibility, allowing both parties to benefit from — or be exposed to — future market movements, fostering alignment with the evolving carbon market.

3. Cost-Plus Model

The concept here is to price carbon credits based on actual production costs with margin. This model ensures the project developer covers their verified costs of producing the credits, plus an agreed-upon profit margin. This transparent approach de-risks the developer by guaranteeing cost recovery, while buyers gain insight into the true cost of abatement.

4. Revenue Sharing (Royalty Model)

This alternative involves agreeing with the investor on a variable revenue share from the future sales of credits, similar to a royalty contract defined as a percentage of turnover. Parties typically set a reference price and then agree on a floating price, which is a specified premium or discount to that reference. This fosters a partnership-oriented relationship, where both parties are incentivized by the ultimate market success of the credits, and share the risks thereof.

5. Hybrid Pricing with Upside Share ("Kick-Back")

This innovative model offers a fixed price up to a certain ceiling, but if the credits are resold at a price exceeding that ceiling, the developer receives an agreed-upon share of the upside ("kick-back"). This encourages a long-term, open-book partnership, where buyers are motivated to maximize the value of the credits, knowing the developer also benefits from higher market prices.

6. Floor and/or Ceiling Prices (Price Bands)

To mitigate significant price fluctuations, contracts can incorporate floor prices (a minimum price the developer will receive) and/or ceiling prices (a maximum price the buyer will pay). Combining both creates a price band, offering a predictable range within which transactions will occur, thereby capping potential returns or losses for both parties.

Cost of Capital

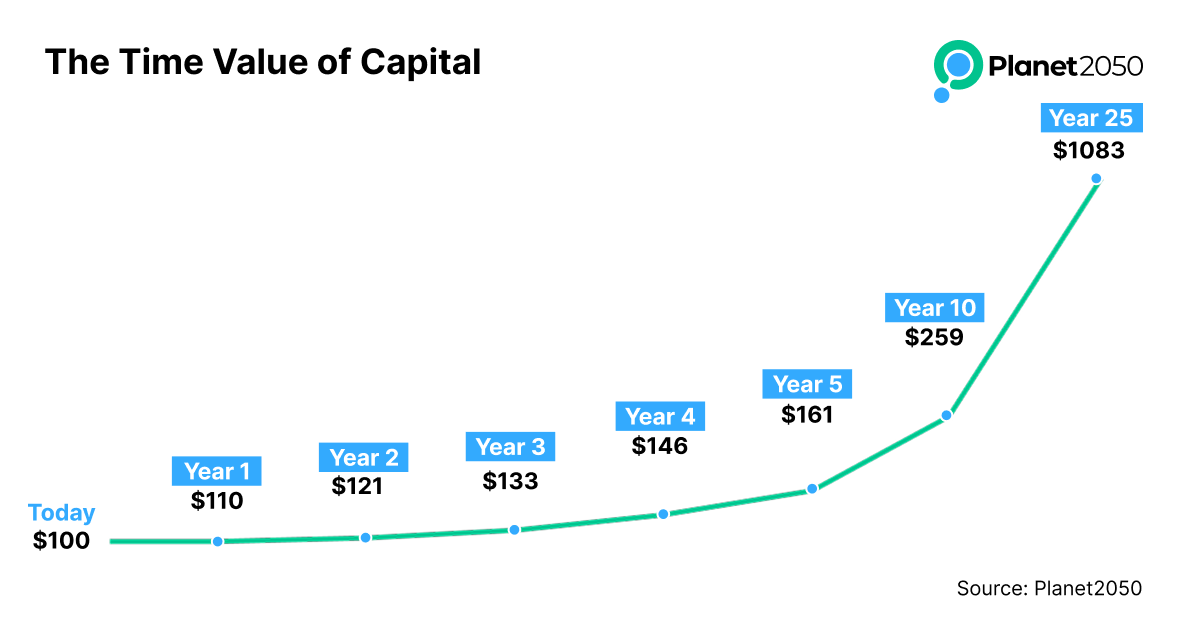

The time value of money is a key factor in the cost of capital, meaning money today is worth more than money in the future. This is why the price of a future asset decreases the further out its delivery date.

For example, an investor with a 10% annual discount rate might pay $100 for an immediate carbon credit. However, for the same credit delivered in one year, they'd pay roughly $91; in two years, about $83; and in ten years, only around $39. This demonstrates how future commitments carry a lower present cost due to the time value of capital.

You can understand it also with the value of $100 over the next 25 years with compound interest effect of 10% per year.

Planet2050’s role in Carbon Financing

Planet2050 provides early capital to project developers in exchange for future carbon credits — using a combination of instruments of equity investment, carbon streaming agreements and forward contracts.

Through upfront financing, technical expertise, and close engagement with project developers, Planet2050 is building a high-quality portfolio — and a new infrastructure for the climate economy.

Project developers can contact us or directly apply through the Project Onboarding Form to submit their project for assessment.

Opportunities for a new Generation of climate investors

For investors, this creates exposure to a new climate-linked asset class with long-term growth potential.

Planet2050 plans to make these investments accessible beyond traditional private finance, to a wider public, through an upcoming public listing in Europe.

Learn more at https://planet2050.earth/investors

Three-Part Carbon Finance Serie

The was Part #2 of our three-part Carbon Finance Series. Check out Part #1 on Carbon Project Financing and Part #3 on Getting Your Project Funding-Ready.

You can also subscribe to Planet2050 at https://planet2050.earth/newsletter