Microsoft’s Leadership in Carbon Dioxide Removal (CDR)

Reading Time: 6min

Microsoft’s Leadership in Carbon Dioxide Removal (CDR)

Despite US’ turn on climate policies, Microsoft keeps making headlines in the carbon market with new investment and offtake agreements in the so-called “Carbon Dioxide Removal” (CDR).

70%, this is the percentage of all-time contracted carbon credits from removal technologies which Microsoft bought until now. Why is this so and how do they do it?

Let’s dig into Microsoft’s strategy in CDR, and the lessons it offers to other companies looking to address their climate impact.

Gold medal on the CDR Leaderboard

The leaderboard of CDR Purchasers shows a clear picture:

Microsoft’s leadership in this space is evident in its ambitious climate goals, aggressive CDR purchasing strategies, and efforts to build a more sustainable future through innovation.

In 2024, it accounted along for 5.1 million tonnes, or 63% of total purchased volume in that year (CDR.fyi)

In 2025, the trends will continue with a new 7 million credits contracted over an impressive 25 year period from Chestnut Carbon, a project developer using afforestation and reforestation is southern United States.

Figure 1: CDR Purchasers Leaderboard (adjusted from CDR.fyi)

Microsoft’s Climate Commitments

Microsoft has made in the past ambitious sustainability commitments.

In 2020, the company announced its goal to become carbon negative by 2030, meaning that it plans to remove more carbon from the atmosphere than it emits across its entire value chain: "While the world will need to reach net zero, those of us who can afford to move faster and go further should do so."

Beyond the 2030 target, Microsoft also committed to neutralizing all of its historical carbon emissions, dating back to its founding in 1975, by 2050.

However, recent updates revealed that Microsoft’s emissions are now 30% higher than its 2020 baseline, due to difficulty to engage suppliers fast enough and the expansion of energy-intensive data centers - partly from the use of AI.

Adding to this, in early January the company announced that it plans to invest $80 billion this year in building data centers, which are known for their high energy consumption.

Recently in March and April 2025 the Tech Giant made new commitments:

3.7 Million Tons of CO2 from carbon capture of US paper mills emissions with CO280

12,000 tons of CO2 from Terradot, developing Enhanced-Rock-Weathering projects in Brazil

44,000 tons CO2 from Minneapolis-based biochar Carba using a combination of pyrolysis and biomass burial method

1.5 million tons CO2 from Climate Impact Partner from reforestation projects in India

6.75 million metric tons of CO2 from Fidelis through portfolio company AtmosClear for BECCS credits (Bioenergy with Carbon Capture and Sequestration).

A Bold Purchasing Strategy for Carbon Removal

In order to steer against its accelerating emissions, the company has made CDR a central pillar of its climate strategy with a dedicated program started in 2021.

These types of carbon credits are issued from projects removing carbon from the atmosphere using different nature- or engineered-solutions such as biochar removals, bioenergy with carbon capture (BECCS) or Direct Air Capture (DAC).

In the first three years of the program, Microsoft contracted over 7 million metric tons (mt), and publicly shared its lessons learned in three whitepapers from FY21, FY22, and FY23.

In addition to scaling up its renewable energy usage and optimizing operations for energy efficiency, Microsoft has significantly invested in CDR technologies as a way to mitigate its remaining emissions.

Microsoft Removal Program, Projects of Interest (Microsoft)

Microsoft’s purchasing strategy is characterized by a combination of large, long-term contracts and smaller-scale purchases designed to test new (“First-of-A-Kind” or FOAK) and less proven technologies, highlighting the role of the company as a catalyst for climate innovation.

Their long term contracts often span 10 years or more. Examples are their BECCS deals with Stockholm Exergi (3.33M tonnes) and Ørsted (2.67M tonnes initially + 1M tonnes expansion).

The company’s CDR strategy is not just about meeting its own emissions targets, but also about scaling up the CDR industry as a whole.

In this context, Microsoft in embracing both breadth and depth in its strategy:

Breadth: The company has engaged with 22 unique suppliers, ranking just behind Frontier Buyers (38 suppliers), Shopify (35), and Milkywire/WRLD Foundation/Klarna (27).

Depth: Microsoft has made the top four largest purchases by volume, securing five of the top six positions. It is also the buyer of the largest deals in the three highest-volume carbon removal methods to date: BECCS, Direct Air Capture and Storage (DACCS), and Biochar Carbon Removal (BCR).

This shows how Microsoft has diversified its CDR investments across various methods. By spreading its investments across technologies, Microsoft aims to de-risk its portfolio while also supporting the scaling of a wide range of solutions.

Innovating the Market and Shaping Standards

In addition to its purchasing efforts, Microsoft focuses on fostering innovation and shaping the future of the CDR market. The company has become a strong advocate for establishing robust standards and policies to guide the development and implementation of CDR technologies.

Through collaboration with other tech companies, governments, and non-governmental organizations, Microsoft is actively working to establish clear metrics for measuring the effectiveness of CDR projects, ensuring that these projects meet high standards for carbon removal permanence, additionality, and verifiability.

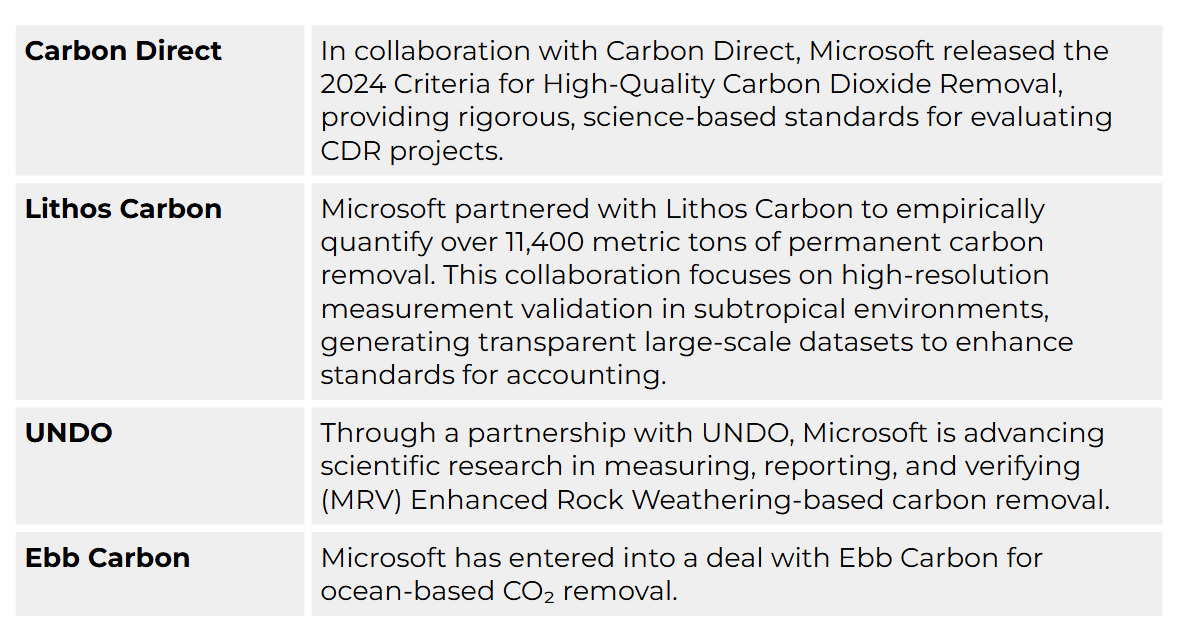

Table1: Example partnerships Microsoft entered to develop and assess CDR projects

Table1: Example partnerships Microsoft entered to develop and assess CDR projects

The Challenges of Scaling CDR

Despite its leadership, Microsoft faces challenges as it works to scale the carbon removal market. While demand for these carbon credits is growing, many technologies remain expensive and proven at scale yet. This is part of the bet of Microsoft, but therefore bears a risk.

What Microsoft may be cooking…

According to estimates from IETA and AlliedOffsets, less than 10% of all companies who have Net-Zero pledges also engaged in CDR investments so far, despite all eventually having to neutralize their residual emissions. What does it mean? That this is essentially a forward market and those understanding it and pioneering CDR offtakes today may be positioned as the key players in the future.

“Technology companies have built their platform business models on the idea to lock value and pass costs to customers. This may well be the case with environmental assets, this is why you see payment companies such as Stripe, or big tech companies like Microsoft, Meta, Salesforce, Workday betting big on carbon credits and especially CDR” comments Lucas Zaerhinger, CEO of Planet2050.

Microsoft’s Environmental Credit Service

Interestingly, Microsoft already has detailed instructions on its Microsoft Cloud for Sustainability learning platform explaining how environmental credits can be managed, issued, transacted and retired.

According to Lucas Zaehringer, “With the advance of corporate carbon accounting and reporting systems and better data integration, we’ll soon see more embedded carbon offering, whereby financial transactions can be automatically “CDR-compensated” within a click.

When you buy 1 kg of green steel in the future, the remaining carbon footprint can be completely neutralized through CDR embedded in your product purchase, without you having the need to source CDR. We could well imagine that tech companies like Microsoft could build the digital infrastructure required for this.

Key Takeaways for Other Companies

Microsoft’s experience in the CDR market offers several important lessons for other companies looking to address their climate impact:

By investing in a variety of carbon removal technologies, companies can de-risk their CDR portfolio. They should explore a range of options and invest in both established and emerging technologies.

Long-term contracts help stabilize the CDR market and provide suppliers with the confidence to scale. That way, companies can support nascent industries and create demand for CDR solutions.

Reports and public sharing of insights enhances transparency. Companies should be proactive in sharing data, collaborating on standards, and helping to create clear frameworks for CDR technologies.

Collective purchasing through alliances of CDR buyers can by a catalyst for growth, bringing more finance at once, building more confidence and de-risking CDR investments

Investment in the future - not only the climate future, secures the future of companies, as their own value chain efforts may not be capable of being fully compliant with future sustainability regulatories.