Reading Time: 7min

Planet2050 was honoured to be invited to the German Business mission organized by the German-Philippine Chamber of Commerce, followed by the Business Opportunity Forum of the Asian Development Bank (ADB) on October 9-10.

The Forum is a one-stop forums for partners, NGOs, contracts working with ADB on project design and implementations.

The Asian Development Bank (ADB), established in 1966 and owned by 68 members, has a key role in Asia to finance prosperous, inclusive, resilient, and sustainable Planet focusing on Asia and the Pacific.

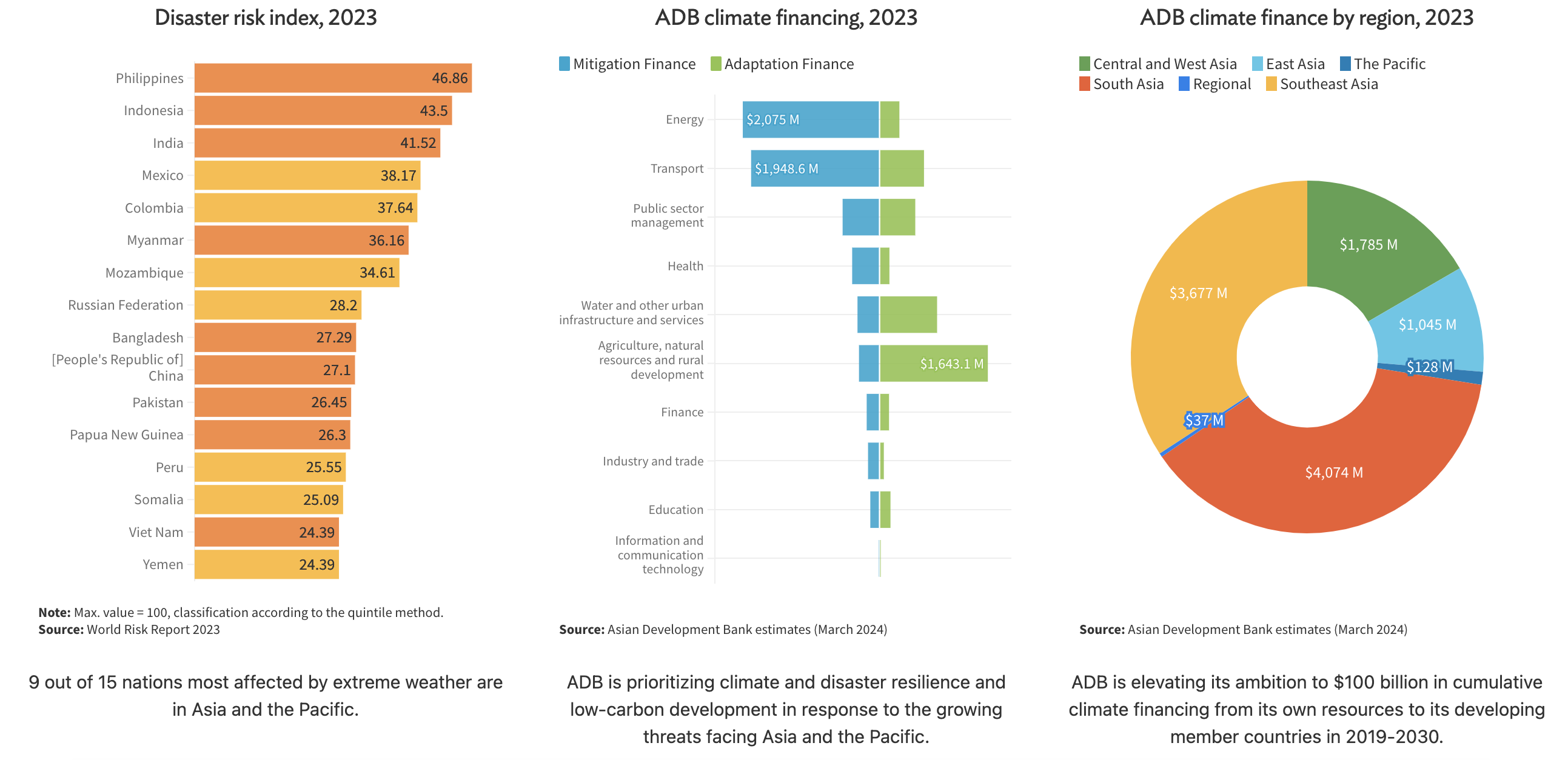

In 2023, the bank committed $23.8B through loans, grants and other funding instruments and $16.4 in co-financing including trust funds. The majority of projects focus on transport and energy infrastructure, but also in areas of agriculture, natural resources, disaster risk and mitigation, education, climate change. About two thirds of funding goes to countries in South and South-East Asian.

One of our key take-aways of the conference is the "Climate-shift" of the development bank which is increasing its budget in climate change, agricultural, natural resources areas but also now seeks for consistent alignment all its financing activities to the Paris Agreement.

ADB plays a crucial role in accelerating climate finance and policies in the region by supporting the funding of major projects and supporting countries meet their Nationally Determined Contributions (NDCs) under the Paris Agreement.

The stakes are high, since according the ADB, Southeast Asia could suffer bigger losses than most regions in the world due to the effects of climate change. Vietnam, Myanmar, the Philippines, and Thailand are among 10 countries in the world most affected by climate change in the past 20 years, according to the Global Climate Risk Index compiled by Germanwatch, an environmental group.

In the Climate area, the development bank committed to provide $100 billion from its own resources from 2019 to 2030, including $34 billion for adaptation.

This funding supports projects that reduce greenhouse gas emissions, enhance climate resilience, and transition to low-carbon economies across its member countries.

The bank’s work also focuses on promoting environmental sustainability and highlighting the link between water, food, and energy.

The fact that Asia is integrated in global value chains (trade), highlights that the clean transition is not strategic only for the region for the whole world, especially as Asia and the Pacific still depends on coal for more than 65% of the energy mix.

To further embed climate action throughout its operations, ADB has released its Climate Change Action Plan (CCAP), 2023-2030.

Climate Change at ADB

One of the key role of ADB is to provide technical assistance and advisory to governments through policy-based loans, focusing among other things on NDC or policies for compliance (carbon tax, Emission Trading Schemes or "ETS"), and voluntary carbon market developments.

As there is no one-fits-all approach to carbon markets, it is important to understand the own context, resources, challenges and opportunities within each single country in order to define the proper carbon pricing instruments, taking into account dynamics from domestic, regional and global trends such as the development of bilateral agreements, regional ETS schemes or the European Carbon Boarder Adjustment Mechanisms (CBAM).

ADB established this unit to support countries in Asia and the Pacific in implementing carbon market mechanisms under Article 6 of the Paris Agreement, mechanism in which countries are able to transfer carbon credits earned from the reduction of greenhouse gas emissions to help one or more partner countries achieve their NDCs. The support facility helps countries participate in global carbon trading and leverage the carbon market to finance emission reductions.

As mentioned in a recent ADB's Article 6 report, "pilot activities in developing member countries of the Asian Development Bank can help Asia and the Pacific develop capacity, readiness, and awareness on using Article 6 and participating in international carbon markets".

ADB is also involved in initiatives like the World Bank's PMR, which assists countries in preparing for carbon market mechanisms, including carbon pricing and emissions trading.

The Future Carbon Fund is a trust fund established and managed by ADB on behalf of fund participants such as Belgium, Finland, the Republic of Korea or Sweden. The fund is a component of ADB's ongoing Carbon Market Program (CMP), which provides financial and technical support for Clean Development Mechanism (CDM) projects. It became operational in January 2009. Concretely, the fund provides finance in the form of offtake agreements on the carbon credits - certified emission reductions (CERs) and verifiable emissions reductions (VERs) - originated from projects in partner credits.

ADB has also been pioneering in developing innovative financing mechanisms that support climate action, such as green bonds and sustainability bonds. These instruments help attract investors interested in environmentally and socially responsible projects, further integrating carbon markets with the broader financial ecosystem.

ADB has developed blue bond instruments which can cover investments that impact ocean health and focus on areas related to marine and coastal management and sustainable development. The ADB has launched a new Green and Blue Bond Framework is aligned with both the Green Bond Principles and the Sustainable Blue Economy Finance Principles

One area of interest for the region is the development of funding schemes for the early retirement of coal-fired plants. These are enabled through ADB's funding to close plants usually 5 years ahead of schedule, compensate for lost revenue and invest in green energy transition. Such projects have been already announced including the first-of-its-kind with the early retirement of the 246 MW coal plant in Batangas, Philippines or more recently Indonesia.

As ADB titled itself, the SDGs Won't Be Achieved Without Private Capital.

ADB is increasingly looking at ways to crowd in private sector investments for climate projects. Quoting the ADB itself: "for the massive financing required to combat climate change, the key will be using limited public sector funds to leverage significant amounts of private capital".

Through initiatives such as blended finance, but also through policy work, ADB can help de-risk investments, making it more attractive for private capital to flow into carbon reduction projects, renewable energy, and other sustainable infrastructure.

In Climate Finance, this can allow private investors, project developers and stakeholders like Planet2050 to come in and accelerate climate action through market-based mechanisms like carbon or biodiversity credits in the voluntary market.

Cofinancing is a key pillar of ADB's Strategy 2030, which targets a substantial increase in long term cofinancing by 2030 with every $1 in financing for its private sector operations matched by $2.50 of long-term cofinancing.

According the ADB's Counsel Henry Cornwell, “the idea behind carbon credits is to incentivise actions that reduce carbon emissions or sequester carbon, such as planting trees or investing in renewable energy projects".

We strongly support ADB's approach to focus on high-quality carbon credits based on science and be cautious about possible market risks: "all offsets should be in line with problems that are based on science. This means we should only support using carbon credits to cancel out pollution that cannot be stopped, reduced, or fixed or to pay for more mitigation measures than the science-based goals for reducing emissions".

Carbon credits "must be in line with the Intergovernmental Panel on Climate Change’s (IPCC) goal of keeping global temperatures to 1.5 degrees above pre-industrial levels and cutting carbon dioxide emissions in half by 2050".

The clear increase of future budget and focus on sectors such as Climate Change, Agriculture and Natural Resources

In particular in the field of Agriculture, ADB plans a.o. to promote Climate-Smart Agriculture, introduce regenerative agriculture practices, decarbonise agri-food value chains, facilitate access to carbon credits, promote digital technologies.

The shift from a project-based approach to a "Systems Transformation to Net Zero" which ADB calls the "Climate Shift".

The increase of nature positive investment especially in: healthy oceans, ecosystem restoration, air quality, circular economy, agricultural value chains.

Learn more:

Subscribe to our newsletter to stay up-to-date with essential carbon market developments and exclusive announcements.