Middle East carbon markets highlighted at Carbon Forward Abu Dhabi

Reading Time: 4min

2025’s first Carbon Forward conference took place on January 16-17.01 in Abu Dhabi, UAE. Our Regional Manager Shinu Jose was present to explore opportunities and meet up with existing and prospective partners.

Climate context in the UAE

Climate risks in the region highlight the urgent need for decisive action and innovative solutions.

By 2040, countries on the Arabian Peninsula are forecasted to be the most water-stressed countries in the world.

By 2050, temperatures may rise to 2.4 °C, and extreme rainfall may increase by 200%.

The need to invest in the climate and energy transition is real. Solutions using public finance but also opportunities from compliance and voluntary carbon markets.

Decision makers in the UAE have recognized the urgency and are aiming to position the country as a premier hub for climate investment and carbon markets as we have seen in recent years

The UAE launched its Net Zero 205 Strategy in 2021 and hosted COP28 in Dubai in 2023, which came together with the launch of carbon market initiatives, trading and auction platforms.

The country introduces strategic programs such as the National Hydrogen Strategy, or also the Abu Dhabi Mangrove Initiative, showcasing its integrated approach to sustainability.

Through initiatives like the Independent Climate Change Accelerator (UICCA) and the UAE Carbon Alliance, the UAE Alliance for Climate Action (UACA) the country is aiming to foster collaboration, research, and innovation to accelerate climate progress. The UAE’s commitment also includes participating in the Global Methane Pledge and the Alliance for Climate Action.

On the investment front, the UAE launched the Global Climate Finance Centre (GCFC) as well as the ALTÉRRA climate fund, committing USD 30 billion to catalyze the USD 250 billion target by 2030, making it the world’s largest private investment vehicle for climate action. ALTÉRRA focuses on investments in industrial decarbonization, climate technologies, sustainable living, and the energy transition.

The UAE also announced a groundbreaking $54 billion clean energy investment plan through 2030, demonstrating its dedication to a renewable energy future.

UAE’S Nationally Determined Contributions

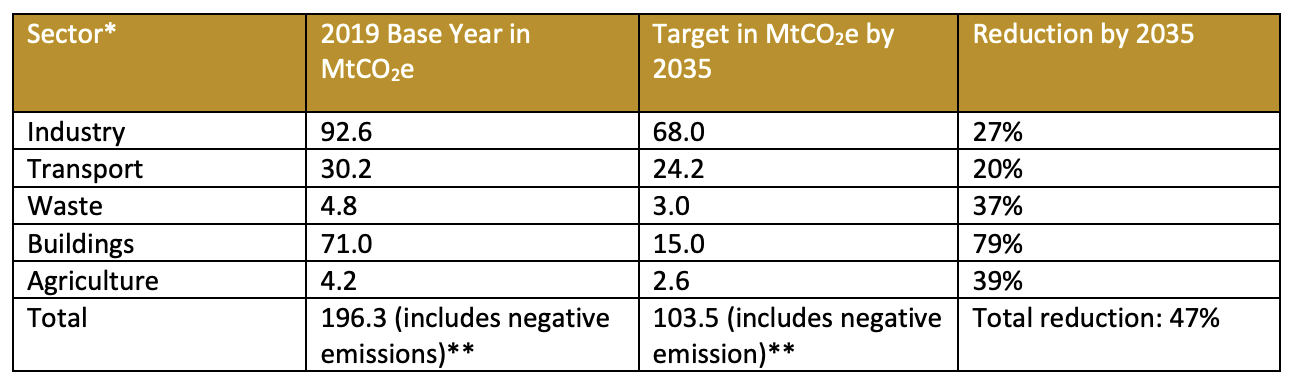

Last November, the UAE had published its third NDC with the goal to reduce its GHG emissions of 47% by 2035.

A number of strategies and emission reduction pathways are presented among following sectors.

In addition, the UAE aims to enhance negative emission capacity to - 9.3 MtCO2e by 2035, through nature based solutions (e.g. mangrove, seagrass) as well as engineered ones (Direct Air Capture).

Although these show ambitions, commenters point out that this is still not enough and not compatible with a 1.5 target. They claim that ongoing policies won’t achieve the targets set for 2035 especially with unaccounted emissions for exported oil, and the fact that the UAE plans to expand its oil business.

GHG Reporting Obligation

Nevertheless, pressure on companies in the UAE will increase with new carbon policy for companies.

Since January 2025, the UAE also became the first country in the Middle-East to introduce a law on Emissions Reporting: public and private entities with greenhouse gas emissions of 500,000 tonnes or more must track and report them.

The policy encourages measures such as using renewable energy, as well as carbon capture and storage.

Failure to report emissions after May 2025 could result in hefty fines up to $550,000.

The policy also includes details of a new national registry for carbon credits, a tool companies can use to offset their emissions.

Take-aways from the Carbon Forward conference

The conference brought together 200 delegates from various fields in global carbon markets.

It highlighted the advancements in the Middle East both on compliance and voluntary carbon markets, addressed the prospects of the EU carbon boards tax implementation (CBAM), the challenges of CORSIA implementation of aviation offsetting, or the role of carbon pricing to create economic incentives and alignment.

Participants were positive about Article 6 carbon market developments announced at COP29 last November, but seemed focused on bi-lateral Article 6.2 in the near terms.

Just a couple of days before the event, the League of Arab States (LAS) signed a deal with a Qatari sustainability institution - the Gulf Organisation for Research and Development (GORD) to enhance regional to boost growth in low-carbon energy and carbon markets in the 22 League of Arab States (LAS), especially focusing on building capacity for Article 6 credits.

Mentions were made of Oman and Morocco positioning themselves to sell credits under Article 6, with UAE & Saudi as potential buyers for such credits.

In another agreement worth mentioning during the IETA MENA Carbon Dialogue on january 15th, IETA and the Global Climate Finance Centre signed a MOU to collaborate on raising climate ambition and promoting the development of market mechanisms in the Middle East and North Africa region.

_____

We look forward to attending the next Carbon Forward in Singapore on 4-5 March!

You can subscribe to Planet2050's newsletter here.