Top 5 most attractive countries for Voluntary Carbon Market Investments revealed

Reading Time: 2min

Abatable, a carbon market intelligence platform, recently published its updated Voluntary Carbon Market (VCM) Investment Attractiveness Index. Discover what are the top countries and key changes.

About the Index

The Index ranks countries based on their regulatory frameworks, market readiness and general condition, and potential for future growth, highlighting the most attractive regions for carbon credit investments.

It recognizes positive policy development, market stability and rich ecosystems for carbon and nature project development. The Index is built around three pillars, multiple indicators:

Global carbon market readiness: Legacy VCM issuance, developer ecosystem, Recent supply of in-demand credits, CDM experience, Forest baseline proficiency, Article 6 engagements, ..

Investment landscape: Political stability, tenure security, Government expropriation risk, Inflation, Foreign Direct Investments, Rule of Law, Financial sanctions, ..

Climate, nature and people opportunity: Opportunities of clean cooking, renewable adoption, electricity access, total biomass, deforestation reduction opportunity, biodiversity conservation potential, CO2 reduction opportunity, ..

Data sources include among others the World Bank, UNFCCC, UNEP, UN CDM, UN FAO, IETA or carbon standard and registries.

Top 5 in the list

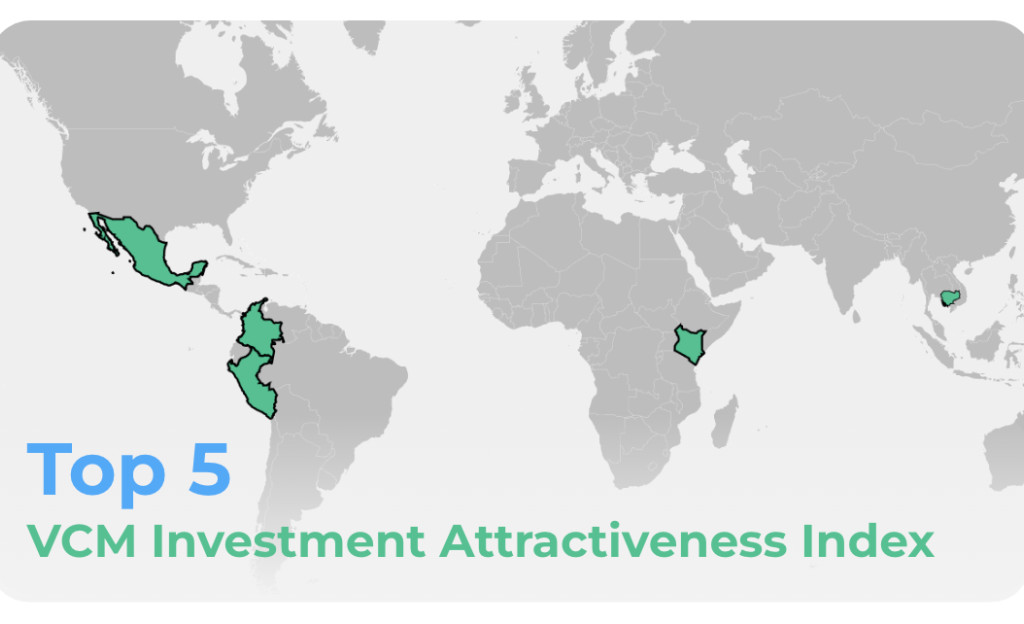

Colombia, Kenya, Cambodia, Mexico, and Peru are the Top 5 countries overall recognized for establishing stable environments conducive to carbon project development.

Top 5 VCM Investment Index countries, Abatable

Colombia

the country scored +11 in the ranking since 2023

Carbon Tax: implemented a carbon tax in 2017, which has incentivized carbon market activity and supported the emergence of leading carbon registries and standards such as Biocarbon, Cercarbono, EcoRegistry

Carbon Credit Issuance: over 142 million tonnes of nature-based carbon credits have been issued from 195 projects since the voluntary market's inception

Rich Biodiversity: as one of the 17 megadiverse countries, Colombia is a leader in nature-based solutions, including forest conservation projects such as REDD+

National Carbon Registry: Colombia established a national registry to track carbon credits, ensuring transparency and accountability

Article 6 Engagement: Colombia is actively participating in global carbon trading under the Paris Agreement, enhancing its international role in carbon markets and cooperation with other governments.

Kenya

Carbon market experience: 191 carbon projects have been developed in the country. Already in 2022, the Berkeley Carbon Trading Project Voluntary Registry Offsets Database ranked Kenya as the second-largest issuer of voluntary carbon market activities in Africa, just behind the Democratic Republic of Congo.

2024 Carbon Market Regulations: Kenya introduced its Climate Change (Carbon Markets) Regulations, providing a framework for the implementation of carbon projects in Kenya, aligning with Article 6 of the Paris Agreement.

Reforestation and Restoration Projects: major projects, including reforestation efforts and renewable energy, have attracted global attention.

At Planet2050, we are financing and enabling project developers to get their projects off the ground, providing essential financing, environmental and technology services through our integrated climate launchpad platform.

We pay the utmost importance to ensure proper market conditions for the secure development of long-term projects which can contribute to a more livable Planet, and welcome monitoring efforts such as the VCM Investment Index from the Abatable team and contributors.

Learn more

Abatable's VCM Investment Index

About the methodology

Subscribe to our newsletter to stay up-to-date with essential carbon market developments and exclusive announcements