The EU plans inclusion of Removals in compliance market (ETS) and other policy instruments

We have highlighted the EU's growing support for carbon markets in a previous article.

This time, we're diving deeper into the potential pathways for integrating Carbon Dioxide Removal (CDR) into EU policy and compliance markets.

The EU's ambitious need for Net Removals

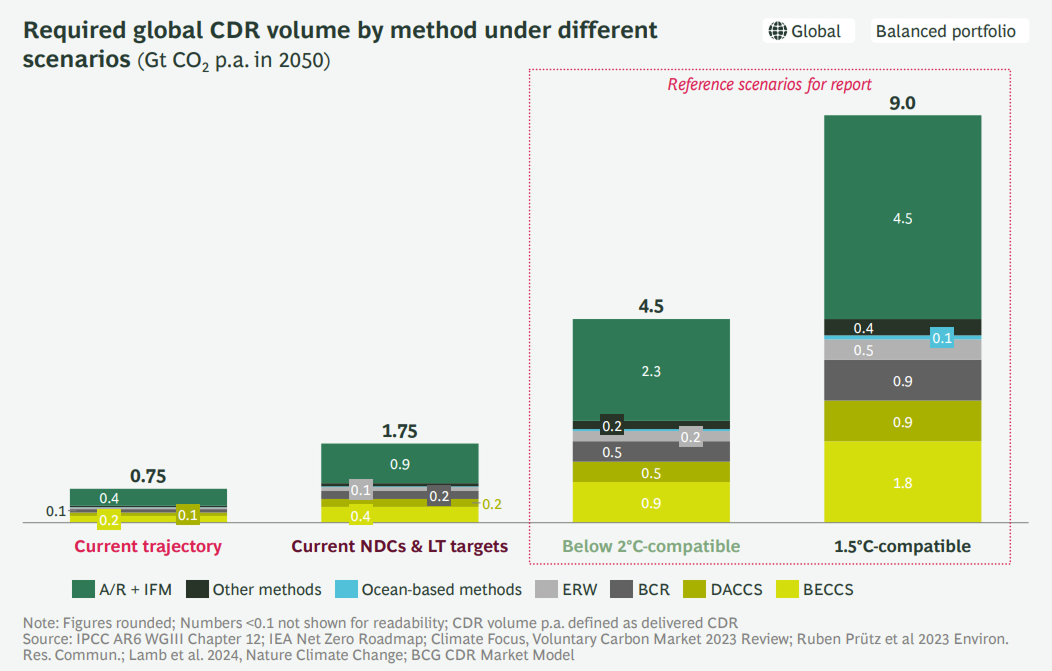

The scientific consensus is undeniable: to align with the 1.5°C pathway, Carbon Dioxide Removal (CDR) needs to achieve approximately 9 gigatons of CO2 removed annually by 2050 globally.

For context, the International Energy Agency (IEA) reports that the combined annual production of the oil and gas industry is around 5.1 gigatons (2022 data).

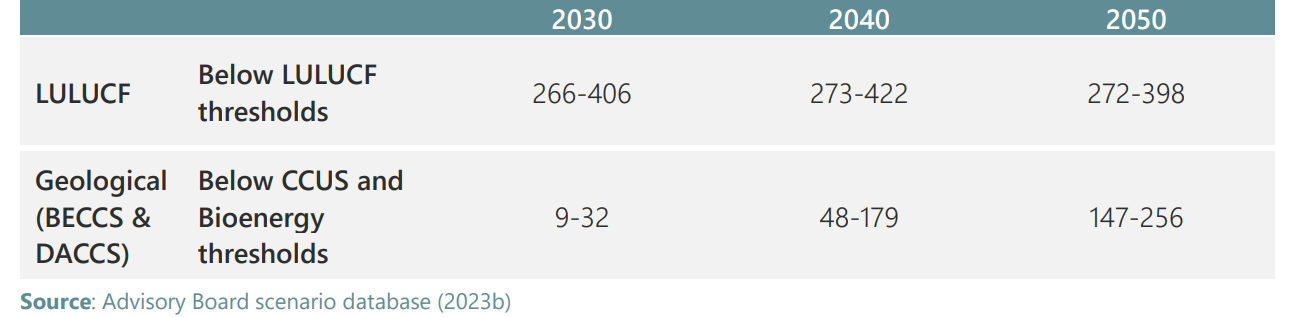

The EU's own 2040 climate target underscores this necessity, projecting a need for at least 400 Mt of net removals per year by mid-century.

This crucial figure has been confirmed by expert reports from the Oeko-Institut here (2025) and the European Scientific Advisory Board on Climate Change (ESAB-CC referred later as "Advisory Board") here (2023).

The Advisory Board's analyses reveal a clear truth: there's no plausible scenario where the EU can achieve its ambitious 90% emissions reduction target by 2040 without substantial reliance on net removals.

While contributions from the Land Use, Land Use Change, and Forestry (LULUCF) sectors are vital, engineered solutions that permanently capture and store carbon dioxide must scale rapidly to form a significant part of the overall climate solution.

Without robust policy support and clear price signals, this essential volume of removals won't materialize. This would represent a missed opportunity not only for our climate goals but also for a burgeoning industry.

As forecasted by BCG and DVNE in 2024, the CDR sector could expand to €220 billion per year by 2050, potentially creating up to 670,000 jobs across Europe (€70 billion and 190,000 jobs in Germany alone).

Decoding Carbon Removal: a Quick Guide to the Technologies

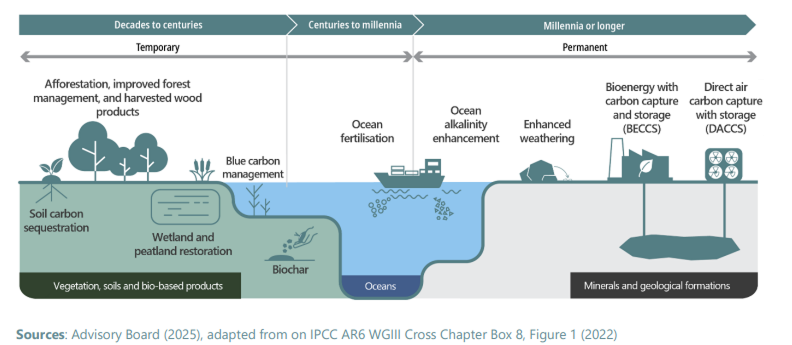

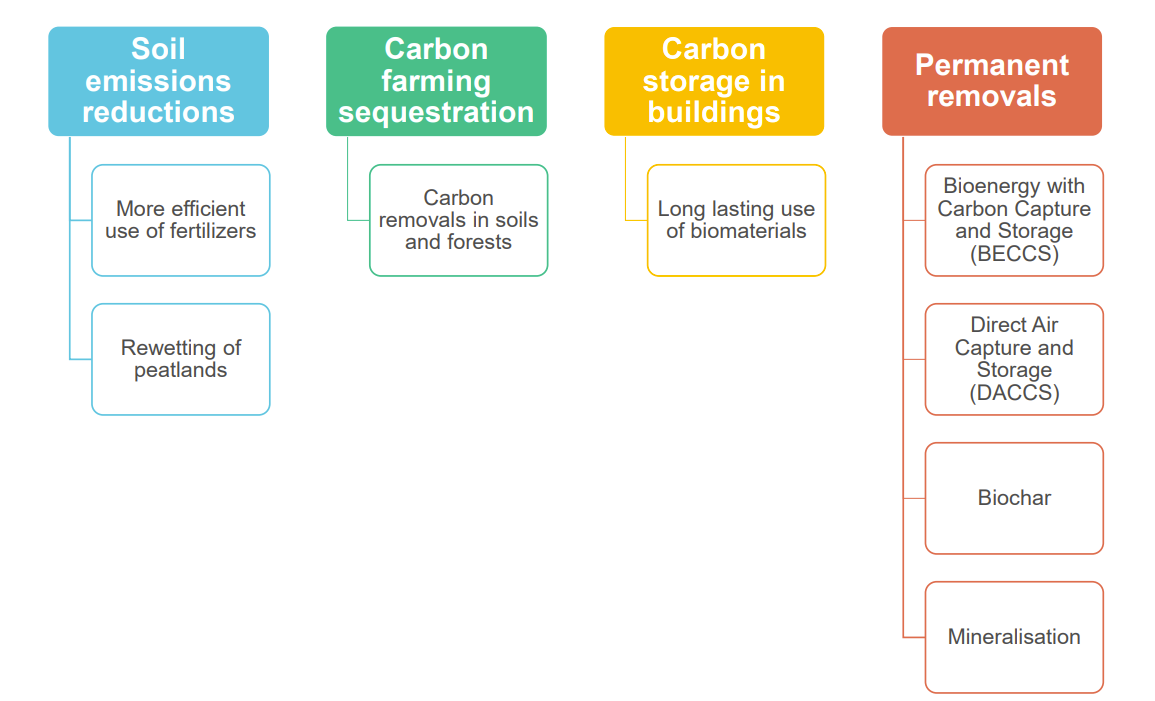

Carbon Dioxide Removal isn't a singular technology; it's a diverse toolkit of methods—whether nature-based, engineered, or hybrid—all specifically designed to pull CO₂ directly from the atmosphere and safely lock it away.

Engineered Removals encompass a rance of methods including:

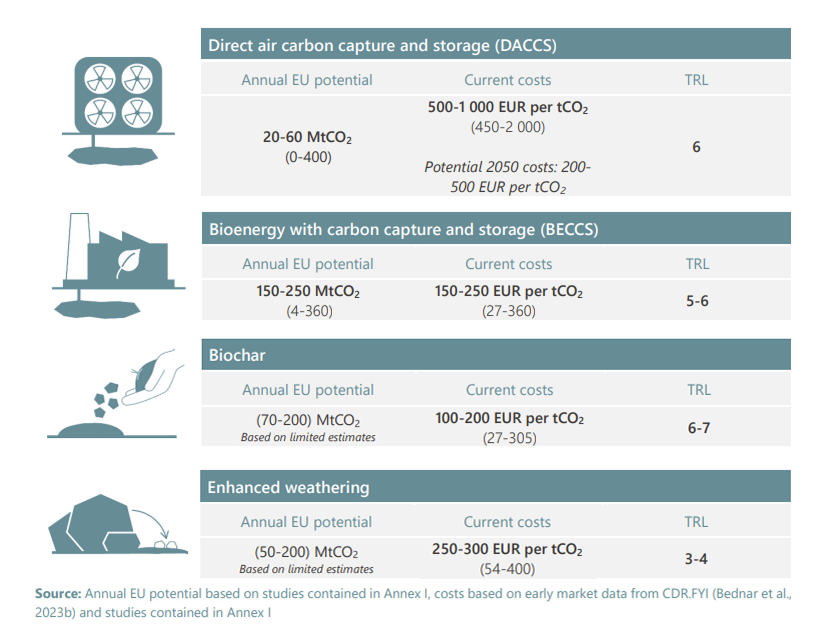

Direct Air Capture (DAC): imagine giant vacuum cleaners for the sky. These high-tech facilities employ chemical processes to extract CO₂ directly from ambient air. The captured CO₂ is then permanently stored deep underground in suitable geological formations.

Bioenergy with Carbon Capture and Storage (BECCS): this method begins with plants. As trees and crops grow, they naturally absorb CO₂. BECCS involves using this biomass for energy (generating electricity or producing biofuels) and then capturing the CO₂ released during combustion before it can enter the atmosphere. This captured CO₂ is also stored underground.

Biochar: essentially a specialized, high-carbon charcoal. By heating organic waste (like wood chips or agricultural residues) in a low-oxygen environment, you create a stable, solid form of carbon called biochar. When integrated into farmland, it improves soil health and sequesters carbon for hundreds of years.

Enhanced Rock Weathering (ERW): certain types of volcanic rock naturally absorb CO₂ as they slowly break down. Enhanced Weathering dramatically accelerates this natural process. The rocks are crushed into a fine powder and spread on agricultural fields, where they react with atmospheric and soil CO₂, permanently locking it away.

Existing EU Funding for CDR Initiatives

The EU has been actively funding CDR and enabling infrastructure since 2020, with a total commitment exceeding €1.3 billion so far:

Innovation Fund: €656 million

Connecting Europe Facility (CEF-E): €614 million

LIFE Programme: €30 million

Horizon Europe: €15 million

European Innovation Council (EIC): €7 million

Beyond direct funding, Member States indirectly support CDR through various EU instruments such as InvestEU, the Just Transition Fund, the European Regional Development Fund, the Cohesion Fund, or the Recovery and Resilience Facility.

Evolving Role of CDR in EU Policy

Discussions on how the EU could and will support CDR have significantly accelerated in 2025, driven by key developments focusing on both short-term and long-term solutions:

Short-Term: designing an EU CDR Purchasing Program to support innovation.

Long-Term: integrating CDR into the EU ETS or developing novel compliance instruments.

1/ Short-Term Initiatives: Catalyzing Permanent Removals

On May 21 2025, the Directorate-General for Climate Action of the European Commission (DG CLIMA) hosted a pivotal high-level workshop in Brussels to shape the future of permanent carbon removals in Europe.

While seemingly a technical discussion, it marked a significant milestone for anyone engaged in the carbon removal space.

The workshop aimed to tackle key questions for scaling removals:

What are the needs and motivations of permanent carbon removal buyers and funders?

What is the most effective design of a "blueprint" for an EU purchasing program in the short term (2025-2030)?

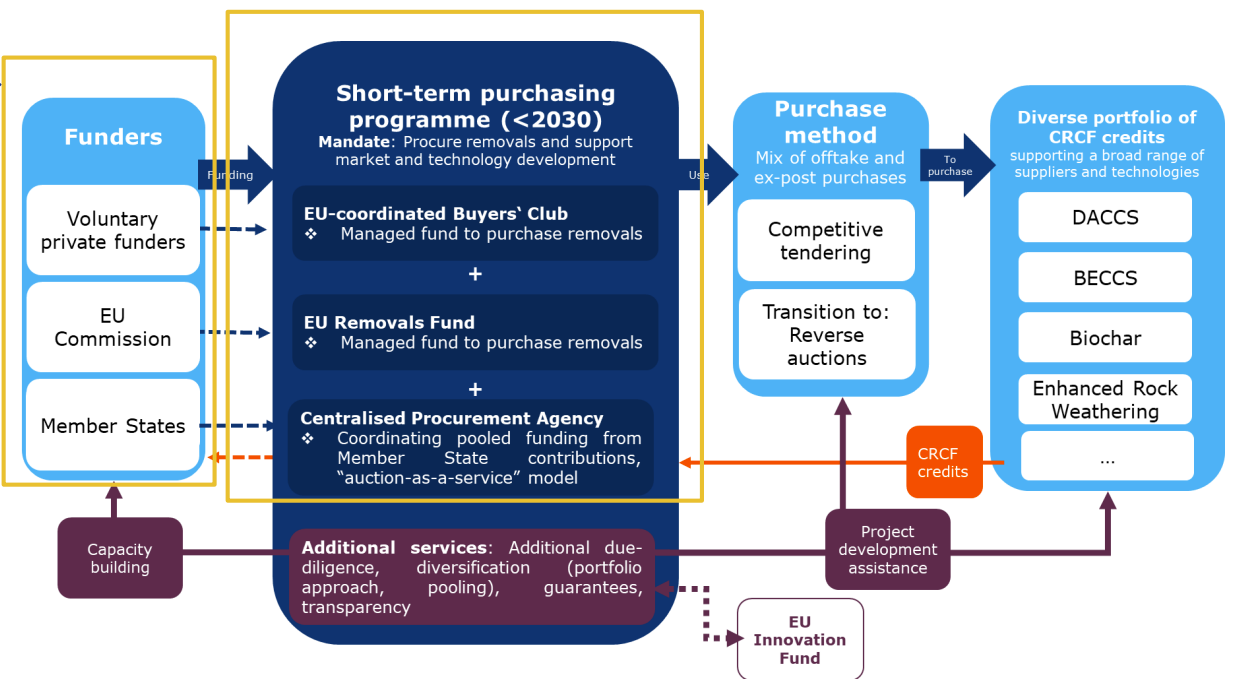

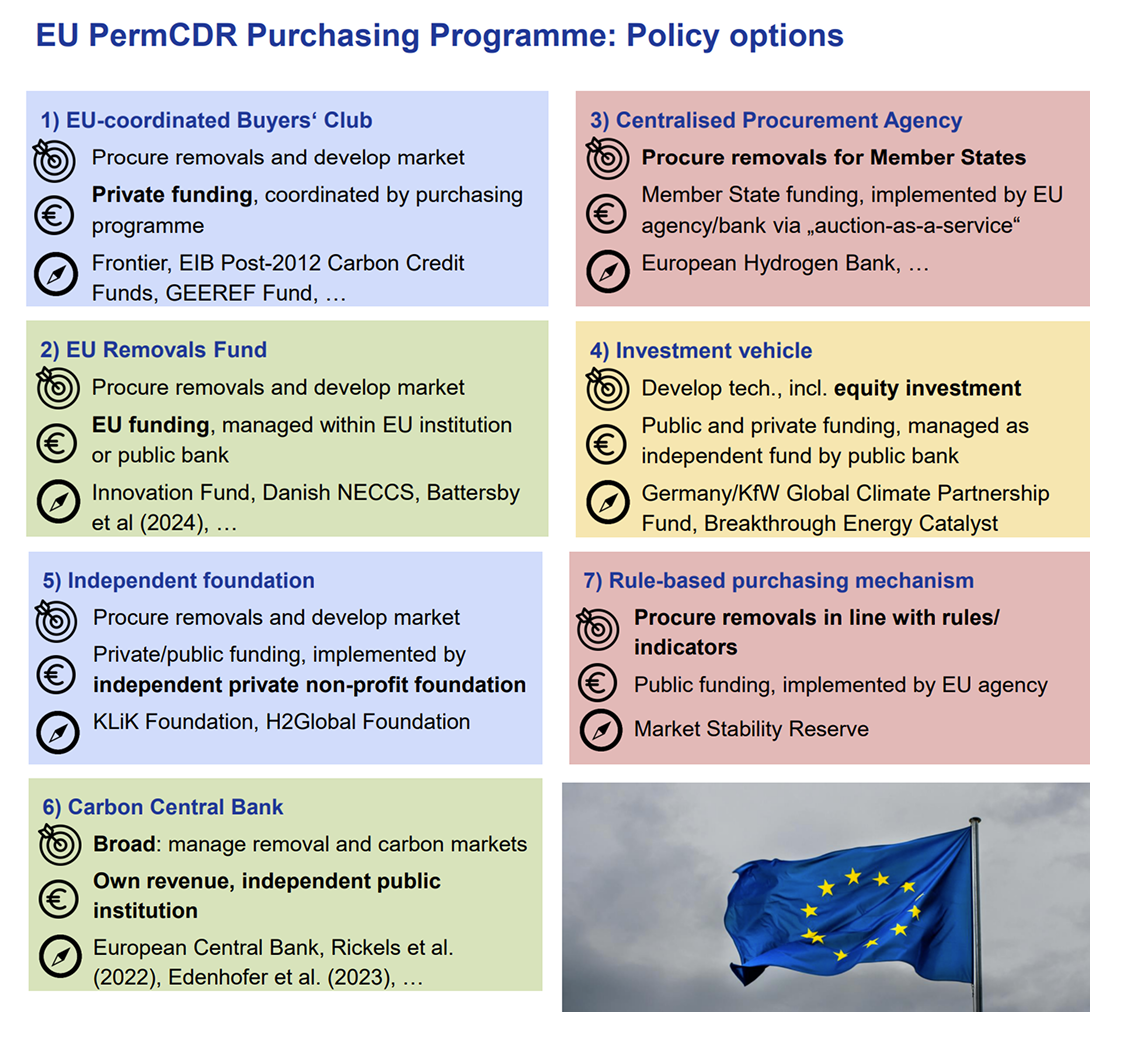

The leading proposal for the 2025-2030 period is a purchasing program based on an EU Removals Fund, combined with an EU Coordinated Buyers Club and a Centralized Procurement Agency.

The EU prepared an overview comparison of potential instruments for Permanent CDR procurmeent ("PermCDR"):

Watch the webinar recording from CDR Policy Scoop for more workshop feedbacks.

Some opinions suggest that procured CDR volumes could count towards the EU’s Nationally Determined Contribution (NDC) for 2035, due before COP30. They also recommend allocating a €50 million budget from a dedicated Innovation Fund call: Net Zero Technologies – Pilots.

2/ The EU's Long-Term Strategy: a Regulated Market for Carbon Removals

The European Commission is actively preparing for a critical review of the EU ETS, scheduled for July 2026.

As part of this process, a public consultation questionnaire, supported by a Call for Evidence document, was launched in April 2025.

The Commission explicitly stated that "carbon removals and carbon capture and utilisation will need both public and private support."

The ETS assessment includes key questions on how negative emissions from CDR could be accounted for and covered by emissions trading.

This has sparked considerable attention and debate on the specific policies the EU might develop to support the CDR industry and integrate it into the ETS and other policy instruments.

Integrating CDR into the EU ETS

The EU ETS stands as a cornerstone policy for achieving the EU’s climate targets, currently putting a price on pollution for over 10,000 major industrial emitters.

In the future, these companies might gain the ability to purchase certified "removal credits" to balance out the emissions they cannot eliminate. This would not only create a substantial, permanent market for CDR but also strengthen the "polluter pays" principle.

The European Roundtable on Climate Change and Sustainable Transition (ERCST), an influential EU think tank, has recommended including CDR in both the main ETS (ETS1) and the new ETS2 (for buildings and transport). Others, however, favor initial integration only into ETS1, managed by a centralized oversight system, before any broader scope is considered.

The ERCST proposes a phased introduction approach. Interestingly, it also advocates for the idea of ex-ante removal credits to incentivize investments, stating:

"The ex ante issuance approach does bring with it some under-delivery risk concerns; however, we believe that an institution with regulatory authority would address this by backing the guarantee, ensuring that credits are honored even if the project under-delivers."

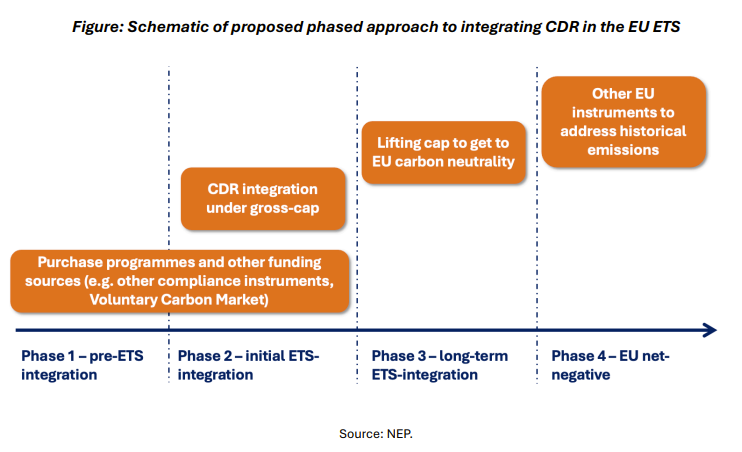

The Negative Emissions Platform (NEP), a Brussels-based CDR partnership group, also supports a progressing integration in the EU ETS in its July 2025 position paper:

The NEP also brings forward the idea of "Contract for Differences" (CfD) as an additional transition instrument: "as CDR methods enter the EU ETS, carbon contracts for difference should be used to bridge the initial price gap between certified removal credits and EU allowance prices, facilitating an eVicient and price competitive entry".

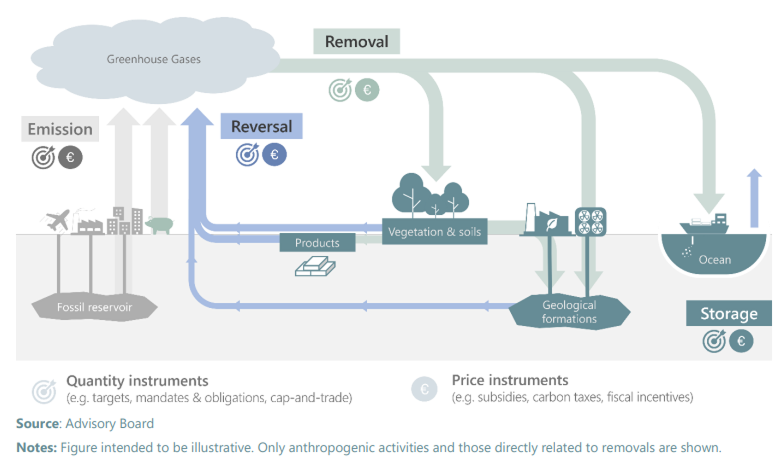

The "Conversion Factor" Concept

The EU has introduced the concept of an "exchange rate," or conversion factor, as one option for integrating CDR into the EU ETS. The underlying idea is that not all CDR methods offer equal permanence and environmental integrity.

For instance, a method that stores carbon underground for centuries would likely be considered more valuable than one that stores it in biomass for a shorter period.

Conversion factors would reflect these differences, potentially adjusting the number of credits needed to offset a tonne of emissions based on the specific CDR method used.

Which permanent CDR Technologies will qualify?

A core principle under discussion for ETS integration is the "like-for-like" approach, meaning that only truly permanent removals should be allowed to offset emissions within a compliance market, thereby ensuring environmental integrity.

This is where the debate becomes critical. For a system as robust as the ETS, the EU needs absolute certainty that when a company buys a "tonne of removed CO₂," that tonne is gone for good, with minimal risk of reversal. This places a strong emphasis on methods with proven long-term permanence and robust, verifiable monitoring possibilities.

Because of these stringent requirements, high-tech, industrial solutions like Direct Air Capture (DAC) and BECCS are currently the frontrunners for inclusion in compliance markets. It is inherently simpler to track and measure the precise amount of CO₂ captured and injected deep underground, where it can remain for millennia.

So, where does this leave methods like biochar and enhanced weathering?

Their future in the EU's compliance framework is still being determined, primarily due to the current lack of extensive, large-scale studies providing definitive evidence of their long-term effectiveness and scalability for compliance purposes.

However, their real potential is acknowledged, as presented in the recommendations by the Advisory Board in February 2025.

Similarly, BCG's proposed balanced CDR portfolio for 2050 includes a significant role for methods beyond just DAC and BECCS (global scope here, not limited to the EU).

In 2025, a letter signed by 246 organizations, including Planet2050, recommended that the European Commission consider a diverse portfolio of permanent CDR methods for inclusion in compliance schemes such as the EU ETS.

For now, it's likely that these hybrid removal solutions will continue to grow predominantly within the voluntary carbon market, where companies acquire credits to meet their own corporate social responsibility goals.

What proponents are saying: Opportunities and Concerns

The debate surrounding CDR integration into the EU ETS is gaining momentum.

Proponents argue that it could create a durable, long-term market and trading infrastructure for CDR, incentivize funding at a greater scale, and provide crucial decarbonization options for hard-to-abate sectors.

Concerns also exist, warning that premature inclusion of CDR in the ETS could undermine the incentive for emitters to reduce their gross emissions (known as "mitigation deterrence") or distort the market.

To address these valid concerns, discussions are exploring strategies like limiting access or quantities of CDR units to specific hard-to-decarbonize sectors and ensuring clear measures for the efficient utilization of biomass-related durable CDR.

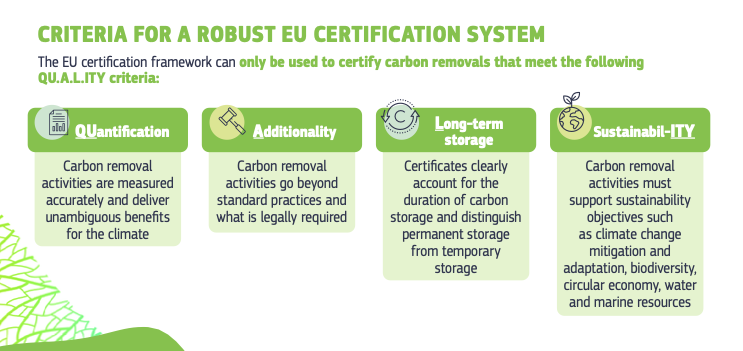

The paramount importance of quality and integrity for chosen methods highlights the critical role of the EU Carbon Removal Certification Framework (CRCF), especially concerning its monitoring, reporting, and verification (MRV) standards.

The Carbon Removal Certification Framework (CRCF): Ensuring Integrity

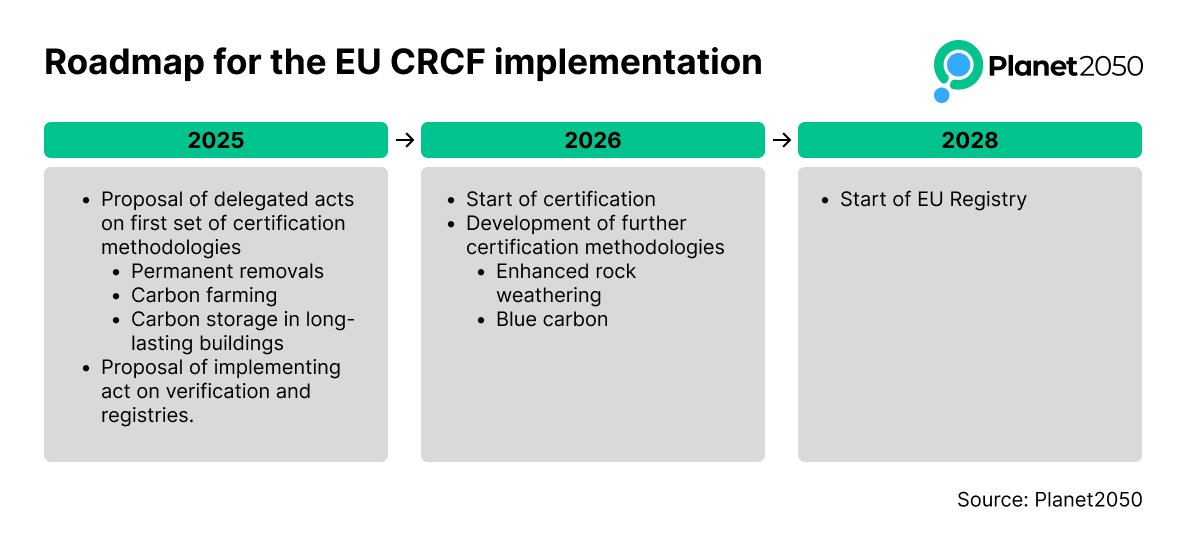

Adopted in December 2024, the CRCF marks a significant development.

It establishes a voluntary regulatory system for certifying permanent carbon removal, carbon farming, and carbon storage in products, ensuring their environmental integrity.

The CRCF will play a key role in policies like the European Green Deal, the LULUCF Regulation, and potentially future integration into the EU ETS, ensuring that verified carbon removals contribute genuinely to climate neutrality. It is also referenced in the Green Claims Directive (GCD) and Corporate Sustainability Reporting Directive (CSRD), Common Agricultural Policy (CAP) or State Aid.

The first set of methodologies released under the CRCF covers specific activities, with detailed guidelines provided by the Commission:

The QU.A.L.ITY Criteria: Pillars of Certification

The CRCF Regulation mandates that certified activities must meet four stringent criteria, known as the ‘QU.A.L.ITY’ criteria:

A public consultation on the initial EU CRCF methodologies is currently open until September 2025, inviting feedback on these crucial standards.

The Commission has already detailed the next steps for the full implementation of the regulation, signifying its commitment to building this foundational framework:

Alternative Paths for CDR Integration Beyond the EU ETS

Given that the EU ETS's primary function is to drive covered emissions towards zero, not necessarily to provide a stable, long-term market for CDR, the EU is also exploring other types of long-term CDR compliance integration, such as a potential

Removal Trading System (RTS)

Carbon Removal associations have proposed various options for EU mechanisms incorporating CDRs, drawing comparisons with EU and US policy instruments.

Carbon Take-Back Obligation (CTBO)

Such instrument would oblige fossil fuel importers/extractors to permanently sequester CO2 equivalent to an increasing portion of the emissions associated with the fuels they bring to market. This places direct responsibility on the source of fossil carbon.

Mandatory CDR Targets

Mandatory CDR targets could also be set at the national level, for example, through the EU’s Effort Sharing Regulation, compelling Member States to achieve specific removal volumes.

Standalone Removal Trading Scheme (RTS)

The core idea here is to establish a completely separate compliance market specifically for CDR. Entities would have an obligation to acquire "removal units" or implement removal projects within this distinct system.

Others suggest a phased approach where an RTS could eventually merge with or be closely linked to the EU ETS, perhaps managed by an "intermediary" or "central bank-like entity" called "European Carbon Central Bank (ECCB)", overseeing the exchange of allowances and removal units.

CarbonGap, in collaboration with CONCITO, is preparing to launch a new in-depth report to be launched during a workshop in Brussels on October 7, 2025, exploring the potential design and impact of a Removal Compliance System (RCS) to complement existing EU policy mechanisms.

Integration into Other EU-Relevant Schemes

Beyond the core ETS, CDR could potentially be integrated into other EU-related schemes:

EU Carbon Border Adjustment Mechanism (CBAM): could eventually include provisions related to embodied carbon in goods, potentially recognizing certified removals.

CORSIA (the international aviation offsetting scheme): EU airlines participating in CORSIA could potentially use EU-certified removal credits.

EU Sustainable Aviation Fuel (SAF) Mandate: while primarily focused on fuel production, future iterations could consider links to emissions accounting or crediting for specific capture methods.

Related EU CDR Policy Developments

The integration of CDR into the EU's climate strategy is deeply interconnected with several other key EU policies, forming a coherent and ambitious framework:

The EU's 2040 Climate Targets: Defining the Removals Ambition

The EU's proposed 90% net reduction in greenhouse gas emissions by 2040 (compared to 1990 levels), enshrined in an amendment to the European Climate Law, explicitly acknowledges the indispensable role of carbon removals.

Corporate Sustainability Reporting Directive (CSRD): Driving Transparency and Demand

Effective for the largest companies from January 1 2025, the CSRD significantly expands and standardizes sustainability reporting. Its influence on CDR is multifaceted:

Mandatory Disclosure of Removals: the CSRD, along with its European Sustainability Reporting Standards (ESRS), specifically mandates companies to separately report their greenhouse gas removals, regardless of where they occur or how they're financed. This includes detailing methodologies, scope, and alignment with climate transition plans.

Focus on Net-Zero Strategies: companies must outline their climate transition plans, pushing them to integrate high-quality carbon removals into their long-term strategies for managing residual emissions.

Increased Demand for Verified Removals: by mandating transparent and detailed disclosure, the CSRD implicitly drives demand for high-quality, verifiable CDR, as companies seek credible solutions to report their climate actions.

Green Claims Directive: Halting Greenwashing and Building Consumer Trust

Expected to be fully implemented by Member States by March 2026, the GCD directly combats greenwashing and ensures the credibility of environmental claims. Its impact on CDR is profound:

Prohibition of Misleading "Carbon Neutral" Claims: the GCD prohibits generic claims like "carbon neutral" if they rely exclusively on carbon offsets. Companies must demonstrate that any "neutrality" is primarily achieved through actual lifecycle emissions reductions.

Emphasis on Direct Reductions First: the directive prioritizes direct emissions reductions. Any carbon credits, including those from removals, used for compensation must be disclosed separately and transparently, reinforcing that offsets complement, rather than substitute, decarbonization.

Link to CRCF: crucially, the GCD explicitly states that any climate-related compensation claims based on carbon credits can only be used if these credits are certified under the EU's Carbon Removal Certification Framework (CRCF), or through equivalent robust schemes, directly linking the integrity of removals to consumer claims.

Net-Zero Industry Act (NZIA): Building Essential Storage Infrastructure

Entered into force in June 2024, the NZIA aims to scale up the manufacturing capacity of key net-zero technologies. While not directly a CDR mechanism, it plays a vital enabling role for industrial CDR:

50 Mt CO2 Injection Capacity Target by 2030: a cornerstone is the binding target to achieve at least 50 million tonnes of annual CO2 injection capacity in geological storage sites within the EU by 2030. This capacity is indispensable for storing captured CO2 from industrial emissions (CCS) and CDR technologies like DACCS and BECCS.

Obligation on Oil & Gas Producers: to meet this target, the NZIA obligates certain EU-based oil and gas producers to contribute proportionally to this CO2 injection capacity, leveraging their expertise to develop critical storage infrastructure.

Strategic Importance for Industrial CDR: adequate and accessible CO2 storage is a prerequisite for scaling industrial CDR. The NZIA's focus on building this capacity directly underpins the future deployment of these technologies, supporting their potential for ETS integration.

Planet2050’s Take: Investing in a Climate-Positive Future

At Planet2050, we believe carbon removals are not just a climate solution; they're a future asset class evolving into a robust, regulated market. That's why we're tracking these EU developments so closely.

We're already working with project developers across multiple methodologies—from engineered removals to land-based storage—to ensure alignment with emerging compliance criteria. For Europe to truly lead, the carbon market must reward integrity. That means making space for innovation while holding firm on rigorous standards. Our recent CDR RFP directly aligns with the EU's policy development and the quality required by the EU CRCF Regulation.

Ultimately, Carbon Removal solutions require significant finance to be deployed and scaled. We're here to build the bridge between capital and climate impact.

CDR is moving from concept to market, and we are thrilled to be part of it, while also opening opportunities to the new generation of climate investors through our upcoming public listing. Learn more and sign up here.