Europe Backs Carbon Markets: France, Germany, UK, EU pushing for greater use of carbon credits

Reading Time: 6min

Missed these key separate announcements in April 2025? We got you covered.

As economic and geopolitical pressures slow down the pace of decarbonization, Europe is doubling down on a crucial — and sometimes controversial — climate tool: carbon credits. In a coordinated wave of announcements, the European Union and three of its most influential members — France, Germany, and the UK — are signaling stronger support for high-integrity carbon markets to accelerate emissions reductions and manage residual emissions.

Here’s a roundup of the major developments that are giving carbon credits renewed political momentum.

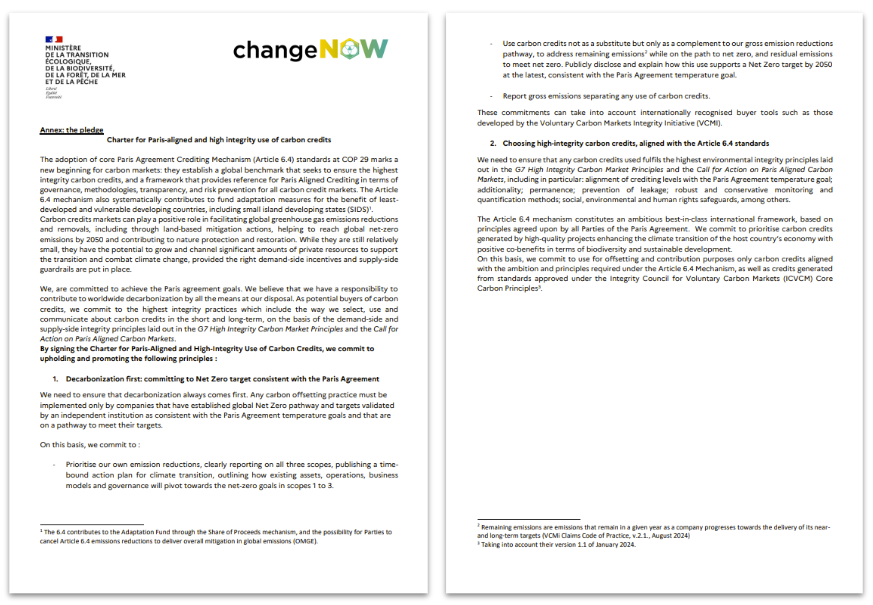

French government launched its Charter for Paris-aligned and high integrity use of carbon credits

At the leading Paris ChangeNow Climate Conference on April 24-26, the French government introduced a new Charter on the use of high-integrity carbon credits.

This two-pages document released by Agnès Pannier-Runacher, the French Minister for Ecological Transition, Biodiversity, Forests, the Sea, and Fisheries, represents a major step towards a more transparent and robust international carbon market.

The charter aims to provide clear guidance for companies on how to invest in carbon credits that align with the rules and spirit of Article 6 as well as integrity initiatives such as ICVCM.

The Charter offers clear guidance for companies on investing in carbon credits that align with Article 6 of the Paris Agreement and with integrity initiatives such as the ICVCM.

It promotes two core principles:

Decarbonisation first: committing to Net Zero target consistent with the Paris Agreement

Choosing high-integrity carbon credits, aligned with the Article 6.4 standards

Several companies such as Schneider Electric have already endorsed it. The initiative marks an important step toward restoring confidence and ambition in carbon markets, offering clear standards that help address previous concerns around credit quality and transparency.

UK: Consultation on High-Integrity Voluntary Carbon Markets

On April 17, 2025, the UK government launched a 12-week consultation on the use of voluntary carbon credits. The UK is planning to adopt frameworks such as the VCMI Claims Code of Practice and ICVCM Core Carbon Principles.

One of the key propositions is to endorse VCMI’s Scope 3 Beta Claim, which Planet2050 has already covered here. The Claim allows companies to use carbon credits on an interim basis while they continue building capacity to reduce internal emissions, as a supporting transition mechanisms with certain operating rules.

For most companies, tackling Scope 3 emissions — such as upstream emissions in supply chains or downstream emissions from product use — takes time. The UK’s approach allows for partial compensation in parallel with reduction efforts, rather than delaying action altogether.

Germany’s leaning toward the use of carbon credits as part of 2040 climate targets?

In April 2025, Germany’s new coalition published its Treaty signaling alignment on 2040 targets and use of carbon credits.

Key elements include:

Support for the EU’s 90% emissions reduction goal by 2040

Recognition of the role of carbon dioxide removals (CDR) in reaching Net Zero

Openness to the domestic and EU-level use of international carbon credits (potentially up to 3% of the 2040 target)

This comes just weeks after Germany’s announcement of a €100 billion investment in the Climate and Transformation Fund (KTF) — aimed at restoring its leadership in climate innovation after years of mixed signals (read more in our latest Blog Post).

The 12-year investment package will support projects across energy, industry, and infrastructure — but only if they meet a key condition: additionality. This means funds must be used beyond existing budgeted expenditures, ensuring real acceleration rather than re-labelling.

EU: ETS consultation and possible future integration of Carbon Dioxide Removals (CDR)

The EU Emissions Trading System (ETS) is a key policy tool for achieving the EU’s climate targets. The Commission is preparing for a critical review due in 2026 and has launched on April 15th, 2025, a public consultation questionnaire supported by a Call for Evidence document.

The document mentions that “over the coming decade, and to achieve climate neutrality by 2050, industry will have to go through enormous transformation to decarbonise and switch to cleaner and more energy efficient technologies.”

It mentions the Clean Industrial Deal and the fact that “carbon removals and carbon capture and utilisation will need both public and private support”. The EU plans to conduct an impact assessment including among key aspects the question of carbon removals:

“Carbon removals (...) it looks at (i) how the EU ETS could account for negative emissions resulting from GHGs that are removed from the atmosphere and safely and permanently stored underground (such as biogenic emissions with carbon capture and storage – BioCCS or direct air capture with carbon storage – DACCS) or permanently stored in products.”

This move aligns with more recent development in the EU on Carbon Removals such as the launch of the EU Carbon Removals and Carbon Farming certification framework, which could play a major role to define integrity with Monitoring, Reporting and Verification (MRV) criteria for future CDR units under EU decarbonization instruments such as the ETS.

EU LIFE Calls for proposal 2025

The EU Commission has released its 2025 EU LIFE Grant Programme on Climate Change Mitigation, and it includes various calls on carbon removals for applications until September 23d.

In particular, the Commission is looking to test innovative technologies; increase capacities for MRV and develop new business models around removals:

Enhanced rock weathering

Biochar carbon removal

Small bioCCS

Ocean alkalinity enhancement

Direct ocean capture

Our take

We welcome the renewed momentum around global carbon markets — and the pragmatic mindset that’s emerging, even in the face of ongoing challenges. Let’s be real: solving the climate crisis is a long, complex journey. At Planet2050, we believe the private sector and capital markets have a vital role to play in speeding up climate action and scaling the technologies needed to reduce and remove emissions.

That’s why the latest announcements from France, Germany, the UK, and the EU are such a positive signal. They reflect a shared understanding:

Carbon credits — when grounded in integrity and guided by science — are essential tools for accelerating decarbonization, addressing residual emissions, and unlocking climate finance.

The path ahead won’t be without challenges, b uut the direction is clear: stronger frameworks, clearer standards, and increasing political support are laying the groundwork for a new era in climate markets — one with real potential for impact.

As confidence rebuilds, carbon markets aren’t just bouncing back — they’re evolving into a central piece of the global net-zero puzzle.

Read more insights on carbon markets at https://planet2050.earth/blog.