Carbon in EU Policy Series (2/4) - EU Member States Leading the way: National CDR Policy Advancements

Reading Time: 11min

In the first issue of this Series, we looked at the German leadership in CDR Procurement with a proposed €476 million federal budget (Part 1/4). In this second part, we explore other European CDR Champion States: the United Kingdom, Sweden, Denmark, and Switzerland.

United Kingdom

The UK's policy on net zero is a foundational commitment enshrined in law. The Climate Change Act 2008, amended in 2019, legally binds the government to a target of net zero greenhouse gas emissions by 2050.

Net Zero Strategy and Carbon Budgets

The government's strategy, primarily outlined in the Net Zero Strategy: Build Back Greener (2021) and subsequent plans, emphasizes a combination of direct emissions reductions and carbon removals.

The UK has set legally binding "carbon budgets" that cap the amount of emissions over successive five-year periods.

While a significant portion of the strategy focuses on direct reductions across sectors like energy, transport, and industry, the government recognizes that certain "hard-to-abate" sectors, such as aviation and some heavy industries, will have residual emissions.

This is where carbon credits and removals become a crucial part of the net zero equation.

Targets for Greenhouse Gas Removals (GGRs)

The UK has set targets for carbon removals referred to as “Greenhouse Gas Removals (GGRs)”, with at least 5 Mt CO₂ per year of 'engineered' removals by 2030, a further increase to around 23 Mt CO₂ by 2035 and 75-81 Mt CO₂ by 2050.

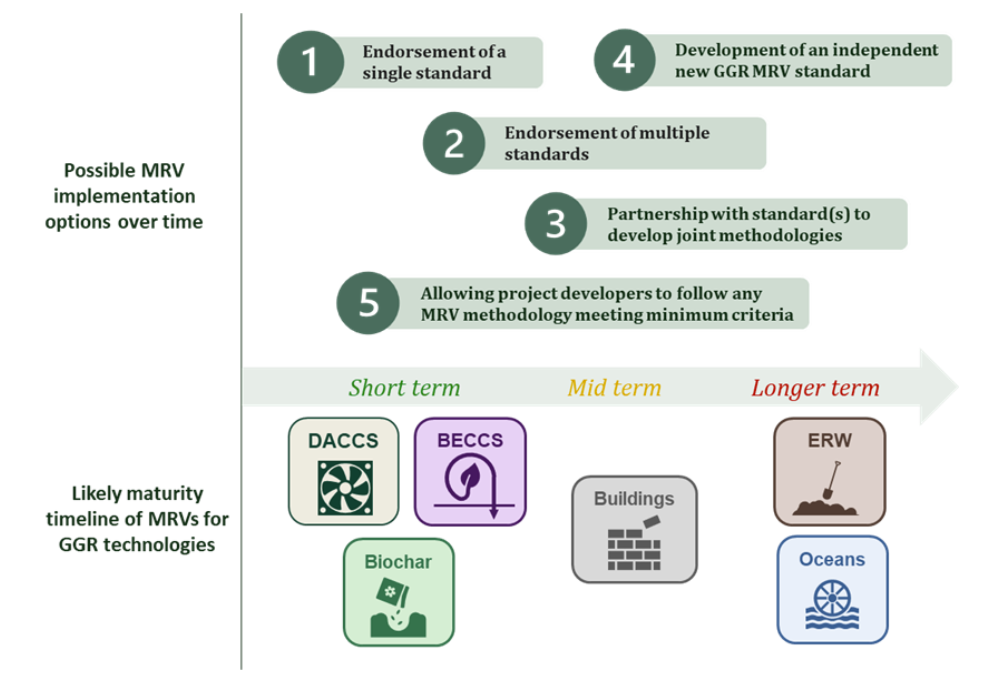

The UK Department for Energy Security and Net Zero (DESNZ) published A Review of Engineered Greenhouse Gas Removal (GGR) Standards and Methodologies together with ERM already in 2023, laying the groundwork for integration:

Direct Inclusion of Engineered CDR in ETS by 2029

A major policy development is the plan to integrate greenhouse gas removals into the UK Emissions Trading Scheme (ETS).

After Brexit, the UK left the EU ETS at the end of the transition period on January 2021. To replace it, the UK government (with Scotland, Wales, and Northern Ireland) established their own, independent UK Emissions Trading Scheme (UK ETS).

The scheme sets a cap on emissions for high-emitting sectors.

While other key carbon policy discussions continue regarding linking the EU and UK emissions trading systems (EU Briefing), UK government's ETS Authority has confirmed in July 2025 its decision to integrate GGRs (removals) into its ETS, aiming for operational status by the end of 2029, following necessary legislation by 2028.

This is a pivotal step, making the UK one of the first major economies to directly include CDR as a compliance option within its ETS.

It will create a single, regulated market where companies can either reduce their emissions or purchase verified removal allowances to meet their compliance obligations.

Main known elements are

Project types: the initial focus will be on engineered removals like DAC and BECCS. The government is also exploring the inclusion of high-quality woodland removals, though no final decision has been made.

Ex-post only: removal allowances will only be awarded ex-post (after verification) of carbon sequestration.

Permanence: projects will need to demonstrate a minimum carbon storage period of 200 years.

Quality matters: the policy framework includes strict criteria, a new UK GGR Standard that is currently under development.

UK first: initially, only UK-based removals will be eligible.

Buffers: the ETS would maintain buffer-pools as a fungibility measure.

The UK ETS Authority plans to maintain the overall cap by replacing emissions allowances with GGR allowances on a one-for-one basis, ensuring continued incentive for gross emissions reductions.

This move is designed to provide a stable financial incentive for the development of carbon removal technologies and projects.

Sweden

Sweden’s climate policy framework is one of the most ambitious globally, rooted in law to provide long-term stability and a clear signal to the market.

Legal Framework

The Swedish Climate Act of 2017, which came into force in 2018, legally obligates the government to pursue a climate policy based on national targets. This framework is a cornerstone of Sweden's commitment to the Paris Agreement.

The nation has set a legally binding target of zero net greenhouse gas emissions by 2045, with the ambition to achieve net negative emissions thereafter.

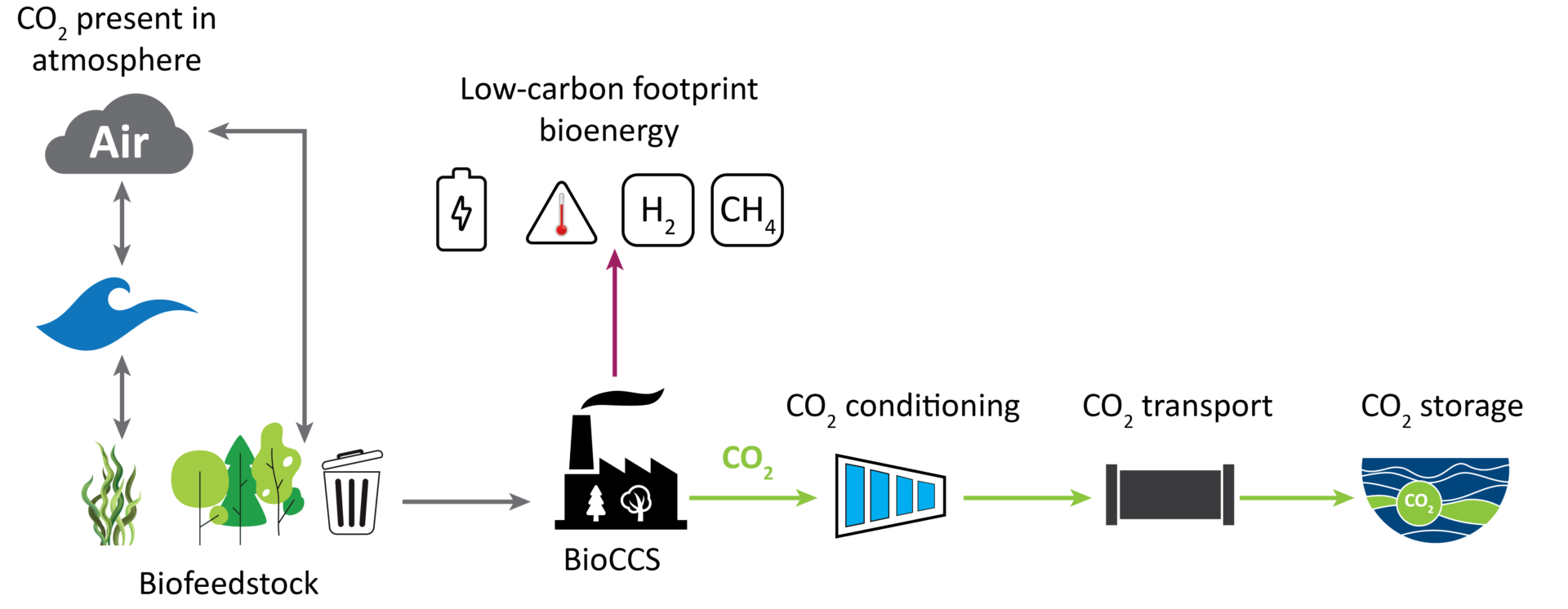

This target implies a minimum 85% reduction in domestic emissions compared to 1990 levels, with the remainder addressed by "supplementary measures" that explicitly include Carbon Removals especially from Bioenergy with Carbon Capture and Storage (BECCS).

Sweden has formally approved the amendment to Article 6 of the London Protocol - a global treaty aimed at protecting the marine environment by prohibiting the dumping of waste at sea - allowing it to establish bilateral agreements for the storage of CO₂ beneath the seabed.

This directly helps unlock Sweden’s national Bio-CCS strategy.

Strong Incentives for BECCS

The Swedish government has allocated SEK 36 billion (€3 billion) for Bio-CCS from 2026 to 2046, to be distributed through competitive reverse auctions.

Bio-CCS auctions: How it works

Project developers compete by bidding the lowest price per tonne of biogenic CO₂ captured and stored. The government then provides economic support to the winning bidders over a 15-year period.

First Auction

The first reverse auction for BECCS support was launched in late 2024. The auction was won by Stockholm Exergi, a major energy utility.

Their winning bid for the “BECCS Stockholm” project secured over SEK 20 billion (approx. €1.7 billion) in support. This funding will be paid out over a maximum of 15 years, starting when the captured CO₂ is permanently stored.

The project involves capturing biogenic carbon dioxide (CO2) from the combustion of biomass at Stockholm Exergi's Combined Heat and Power (CHP) biomass-fired plant. This captured CO2 is then liquefied and transported for permanent underground storage, primarily in the North Sea.

The project utilizes a proven technology called Hot Potassium Carbonate (HPC) for CO2 absorption.

It is expected to permanently remove 800,000 tonnes of biogenic CO₂ per year once fully operational. This is a significant volume, equivalent to more than the annual emissions from all of Stockholm's road traffic.

Source: BECCS Stockholm

In March 2025, Stockholm Exergi announced an investment decision to proceed with the facility, with a planned investment of approximately $1.4 billion, and a goal to have the facility operational in 2028.

Role of Voluntary Credits

The Swedish government has specifically designed its support system to allow BECCS project developers to sell carbon credits on the voluntary market.

This is a deliberate policy choice intended to kick-start a new market for carbon removal and reduce the long-term reliance on taxpayer money.

The policy stipulates that buyers of these credits must acknowledge that their purchase contributes to Sweden’s national climate targets.

By integrating these two financing streams, Sweden is pioneering a hybrid model that encourages private investment in climate solutions.

In May 2025, Microsoft and Stockholm Exergi signed a landmark agreement for the purchase of carbon removal credits from the BECCS Stockholm project, an extension from a previously announced deal.

It is the largest of its kind for BECCS engineered removals, demonstrating Microsoft's commitment to scaling these technologies.

The deal covers a ten-year period, with Microsoft committing to purchase a total of 5.08 million metric tons of permanent carbon removal credits. This equates to an annual purchase of about 500,000 tonnes of carbon removal.

Further initiatives in Sweden include a proposed tax reduction on electricity for negative emissions projects and ongoing state-funded support for CDR research and development through programs like the Industrial Leap.

Denmark

Denmark remains the only EU member state with operational deployment incentives specifically for CDR and Carbon Capture and Storage (CCS).

The Danish Climate Act of 2020 is targeting carbon neutrality by 2045 and a 110% reduction in greenhouse gas emissions by 2050 compared to 1990 levels, with CDR playing a key role in achieving both objectives.

Dedicated Funds and Tenders for CCS and CDR

The Danish government has established dedicated funds, most notably the Fund for Negative Emissions via CCS (NECCS fund) and a broader CCS Fund, with a combined value of over €4 billion. These funds are designed to provide long-term, direct support to projects that capture and permanently store CO₂.

First NECCS Funding Tender

In early 2024, the Danish Energy Agency completed the first tender from the NECCS fund, awarding contracts to three companies in April 2024.

These projects will collectively capture and store 160,350 tonnes of biogenic CO₂ annually from 2026 to 2032. This corresponds to the annual CO2 absorption from approximately 16,000 hectares of forest.

The support is provided in the form of a subsidy paid per tonne of CO₂ permanently stored, directly de-risking the projects and providing a clear revenue stream.

BioCirc CO2 ApS: 968.5 DKK (€125.9) per tonne of CO2 for 130,700 tonnes stored annually

Bioman ApS: 1,117.5 DKK (€145.3) for 25,000 tonnes stored annually

Carbon Capture Scotland Limited: 2,600.0 DKK (€338) for 4,650 tonnes stored annually.

Larger CCS Tender

Following this, a much larger tender was launched with a budget of DKK 28.7 billion (approx. €3.9 billion), with contracts expected to be awarded in late 2025 or early 2026. This tender is projected to deliver an additional 2.3 million tonnes of annual CO₂ reductions by 2030, a key milestone for meeting the national targets.

Source: Carbon Gap

The Strategic Focus on Biochar and Geological Storage

Denmark's approach is highly pragmatic and diversified, targeting both engineered and nature-based solutions:

Biochar Carbon Removal: Recognizing the potential of biochar to sequester carbon in agricultural soils, the government has launched a dedicated Pyrolysis Strategy and Work Program. This initiative aims to remove 300,000 tonnes of CO₂ by 2030 by promoting the use of biochar. It includes a planned subsidy scheme for biochar stored in agricultural soils from 2027 and efforts to streamline regulations and environmental assessments. The government is also exploring the introduction of an agricultural carbon tax that could be linked to incentives for CDR, creating a powerful market signal.

Geological Storage Hub: Denmark aims to become a major European hub for CO₂ storage. Its geological surveys show significant potential for storage in its subsoil, particularly in the North Sea. The government has already granted licenses for the exploration and use of these sites and is actively pursuing international partnerships to facilitate cross-border CO₂ transport and storage, positioning itself as a leader in a global carbon market.

Switzerland

Switzerland is advancing one of Europe’s most structured approaches to integrating CDR into national climate policy.

Climate and Innovation Act (CIA)

The Climate and Innovation Act (CIA) is a landmark piece of legislation that legally anchors Switzerland's long-term climate goals.

It was approved by public vote in June 2023 and came into force on January 1, 2025. The law does not impose new taxes or levies but instead uses incentives and financial support to drive decarbonization.

These roadmaps must include CDR targets to offset both direct and indirect emissions, with binding milestones at five-year intervals,with targets for 2035, 2040, and 2050.

For example, by 2050, the building and transport sectors must be at 100% emission reduction compared to 1990 levels. The obligation applies to all Swiss businesses outside of the agricultural sector and is a prerequisite for companies seeking financial support under the CIA. Companies are also encouraged to include CDR targets in their net zero roadmaps.

Funding Mechanisms for Innovation

The CIA also provides dedicated funding for innovative CO₂ capture, removal, and storage technologies, by allocating a significant budget of up to 1.2 billion Swiss francs (€1.27 billion) over six years to support companies developing and implementing these technologies.

As part of this effort, Switzerland has launched a call for tenders for carbon management solutions with the ambitious goal of securing capacity to store 500,000 tonnes of CO₂ by 2030. This initiative aims to spur large-scale investment in CDR and Carbon Capture and Storage (CCS) technologies from both the public and private sectors, helping the country meet its net-zero emissions targets.

Strategic partnership on CCUS and CDR with Norway

Norway and Switzerland have signed in June 2025 a landmark agreement to strengthen cross-border cooperation on carbon capture, utilization, and storage and CDR under Article 6 of the Paris Agreement. The deal creates a legal framework for CO₂ transport and storage and includes pilot activities to test how international carbon markets can function between two industrialized nations.

‘This agreement is a pioneering step. It enables us to test how international cooperation on CCS and CDR can work in practice – with high environmental integrity and mutual benefit. Norway has more than 27 years of experience with safe and permanent CO₂ storage, and we are proud to offer this as a service to European partners‘, said Norwegian Minister of Energy Terje Aasland. This is the first agreement of its kind under Article 6.2, positioning Switzerland as a pioneer in linking domestic climate policy with international carbon markets.

Conclusion

Europe’s CDR frontrunners are translating climate targets into market signals. The UK’s ETS integration creates regulated demand, Sweden’s reverse auctions set price benchmarks for BECCS, Denmark’s multi-billion funds de-risk storage and scale supply, while Switzerland links corporate obligations with cross-border Article 6 trade.

Together, these policies are not just climate measures but the early architecture of a European CDR market, defining how capital will flow, how credits will be priced, and how removals will enter compliance systems.

Planet2050’s role in Carbon Removals

Planet2050 provides early capital to Carbon Removal project developers in exchange for future carbon credits — using a combination of instruments of equity investment, carbon streaming agreements and forward contracts.

Through upfront financing, technical expertise, and close engagement with project developers, Planet2050 is building a high-quality portfolio — and a new infrastructure for the climate economy.

Monitoring policy and market development is key to Planet2050, in order to ensure our investment decisions are future-proof and aligned with the trend of institutionalization of the nascent carbon removal market.

Opportunities for a new Generation of climate investors

For investors, this creates exposure to a new climate-linked asset class with long-term growth potential.

Planet2050 plans to make these investments accessible beyond traditional private finance, to a wider public, through an upcoming public listing in Europe.

Learn more at https://planet2050.earth/investors

Our Four-Part EU Carbon Policy Series

This was Part #2 of our four-part EU Carbon Policy Series. Check out Part #1 about Germany’s leadership and stay tuned for upcoming ones.

Or subscribe to Planet2050 at https://planet2050.earth/newsletter to never miss the most important Carbon Market News.