Reading Time: 5min

On July 7th, the European Commission unveiled its Roadmap towards Nature Credits, charting a bold course to unlock private finance for Europe’s ecosystems.

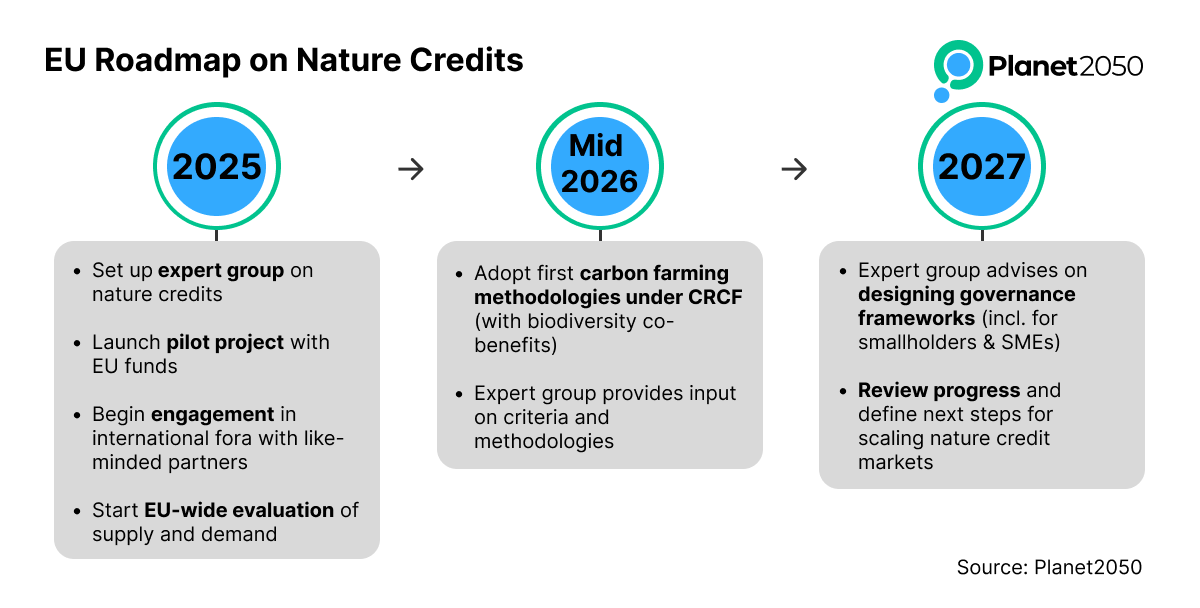

At its core, the roadmap proposes the creation of “nature credits”—certified, tradable units representing measurable improvements to biodiversity and ecosystems. It sets out a progressive implementation pathway, from 2025 to 2027, for pilots, standard-setting, and regulatory framework development.

Nature underpins our entire economy: over half of global GDP and two-thirds of the EU’s economic value rely on nature’s services, from pollination and water filtration to carbon storage and soil fertility. Yet, as the Commission notes, these services remain “invisible” in markets, leading to chronic underinvestment in restoration and conservation.

According to the Global Biodiversity Framework (GBF), the world needs to spend $700bn a year to protect and restore nature. Target 19 of the GBF acknowledges that public money alone cannot fill the biodiversity funding gap and calls for investment in innovative financial solutions to help mobilise $200bn a year by 2030.

The EU roadmap seeks to bridge this gap, turning nature-positive action into a source of income and resilience for farmers, Indigenous Peoples, foresters, fishers, land managers, and local communities.

The roadmap incorporates the lessons learned by several Member States and non-EU countries that are already piloting biodiversity finance models (France, Estonia, Peru) blending public and private capital.

EU Environment Commissioner Jessika Roswall emphasized that the roadmap is “not about turning nature into a commodity, but about recognising and rewarding actions that restore and sustain nature”.

The Commission has launched a public consultation (open until September 30, 2025) and will set up an inclusive EU expert group before the end of 2025. This group will bring together governments, scientists, Indigenous Peoples, local communities, farmers, businesses, civil society, and financial institutions to co-develop methodologies, governance frameworks, and MRV best practices. Applications for the first selection phase are open until 10 September 2025 here:

Certification first, credits later: the EU plan takes a phased approach - independent certification of nature-positive actions forms the basis for issuing credits using science-based biodiversity metrics.

Integrity by design: drawing lessons from the voluntary carbon market, the roadmap emphasizes strict governance, transparency, and safeguards against greenwashing and double counting.

Beyond Carbon: it requires carbon farming activities to generate co-benefits for biodiversity and ecosystem services within a singular credit mechanism. This matches a growing market trend: buyers increasingly value robust credits that offer co-benefits, particularly those linked to nature-based solutions.

Robust MRV systems: central to the roadmap is the development of strong MRV frameworks to track progress, ensure credibility, and maintain trust. Without reliable MRV, nature credits risk falling into the same integrity pitfalls as some parts of the carbon market.

Pilots and seed funding: early-stage projects will test models across the EU and beyond, with EU funds helping de-risk investments and build market readiness.

Supporters see the roadmap as a timely blend of innovation and pragmatism. Many claim nature credits could be a key tool for driving private finance into nature: a pathway to properly recognise nature in economic systems paving the way for the integral transformation we need.

The World Economic Forum has called nature credits a promising tool to finance nature-positive transitions, especially when designed with “additionality, transparency, and local benefits.” Meanwhile, the European Investment Bank highlights its potential to attract private capital into high-impact projects like wetland restoration or pollinator habitat recovery.

Brussels-based think tank Bruegel described the policy initiative as an opportunity to “channel investment to high‑impact conservation efforts and reward land stewards” but stressed the need for “scientific rigour, long‑term durability, transparent governance and equitable benefit‑sharing.”

On the other end of the spectrum, opponents claim that the roadmap’s market approach is a political distraction and a cover for Commission’s regulatory inaction.

Looking at the bigger picture in the EU there is a weakening of environmental regulation and thus many critics are concerned that nature credits could be used to justify delaying and watering down environmental regulations by outsourcing public responsibilities to the private sector.

Overall, many experts question the business case for nature credits highlighting persistent uncertainties around demand, measurement, and long-term financing.

At Planet2050, we see the EU roadmap as a momentous opportunity -but only if designed with care and thoughtfulness while leveraging adapted emerging technologies.

The roadmap is right to call for certification before crediting. Measurement must come first: without robust MRV systems, there can be no trust, no integrity, and no true progress. In addition, we need ambitious but practical biodiversity indicators, co-developed with scientists, land managers, and Indigenous knowledge holders. We call for:

Integrity first, markets second: Robust certification, governance, and social safeguards are critical.

Centering local and Indigenous leadership: Ancestral ecosystems stewarding must have a seat at the table and share in the benefits.

Science-based but practical MRV: Reliable, transparent, and inclusive MRV systems are essential to track biodiversity outcomes and maintain trust.

That’s why Planet2050’s BioCarbon dMRV Working Group is actively collaborating on digital tools and open-access systems to support credible environmental credit markets.

Between 2025 and 2027, the Commission will take steps to support the development of nature credit markets in close cooperation with Member States, stakeholders and international partners.

It is still unclear whether the Commission envisions a voluntary or compliance-based market or both, and whether Member States will be supported to design their own frameworks or expected to align under a single EU-wide or even global system.

However, Planet2050 is keen to be part of the unfolding conversation and contribute its expertise on the environmental markets and digital MRV to the EU expert group and pilot projects.

We invite all stakeholders to join this process—by engaging in the public consultation and collaborating through initiatives like our BioCarbon dMRV Working Group to help shape a future where nature thrives beyond markets and beyond business as usual.

Read more carbon markets insights at https://planet2050.earth/blog.

You can subscribe to Planet2050's newsletter here.