Primer on Carbon Finance (3/3): Getting your Carbon Project Funding-Ready

Reading Time: 13min

Final stage of our three-part Carbon Finance Series, this post helps you get your project Funding-Ready. Check out Part #1 on Carbon Project Financing and Part #2 on Carbon Pricing.

Understanding What Carbon Investors Look For

Carbon investors, whether private or institutional, evaluate projects on a blend of criteria including financial viability and environmental impact.

Key Financial Metrics for Project Evaluation

When assessing a project's financial viability, carbon investors will look at key financial parameters related to a project's yield, its current and future carbon prices, the time to initial issuance and payback period.

A climate project is then interesting for a financial investor if the project generates profits in the medium term that exceed the costs of the invested capital.

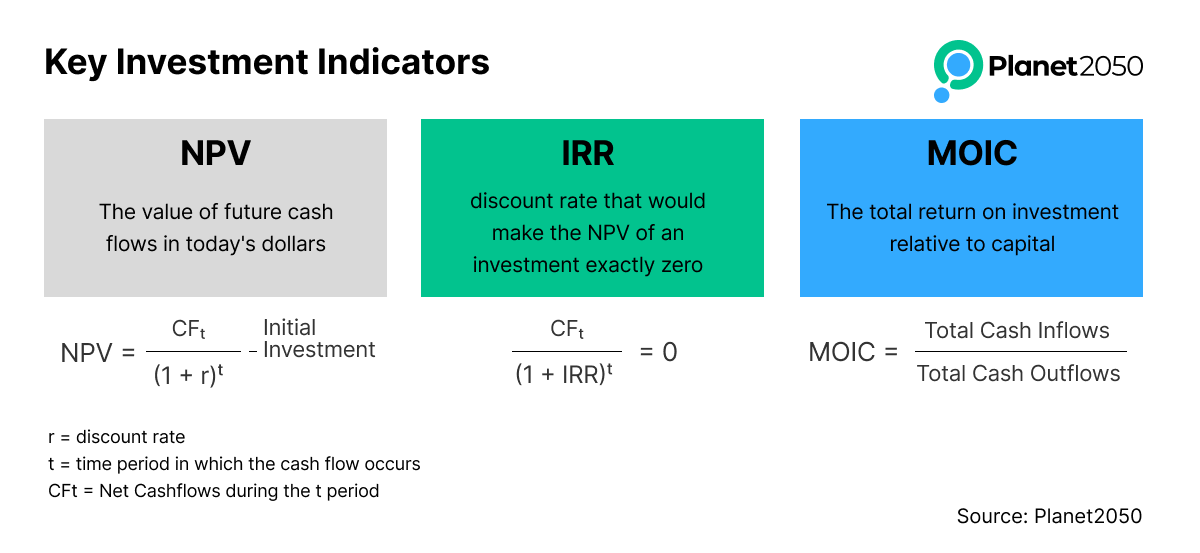

Net Present Value (NPV)

The NPV tells you how much value a project is expected to add (or subtract) in today's money.

It takes all the money expected to flow in and out of a project over its lifetime (total cashflows) and converts it to its value today, using a discount rate that reflects the cost of capital and risk.

If the NPV is positive, the project is expected to be profitable and add value. The higher the positive NPV, the more value the project is projected to create.

Internal Rate of Return (IRR)

The IRR is essentially the effective annual interest rate that a project is expected to earn. It's the discount rate at which the project's NPV becomes zero.

Investors compare the project's IRR to their "hurdle rate" (their minimum acceptable rate of return or cost of capital).

If the IRR is higher than the hurdle rate, the project is considered financially attractive because it promises a return greater than the cost of funding it.

Multiple on Invested Capital (MOIC)

MOIC is a straightforward ratio that shows how many times an investor's initial investment is returned. It's calculated by dividing the total cash received from an investment by the initial cash invested.

A MOIC of 2.0x means for every dollar invested, the investor expects to get two dollars back.

It provides a quick and intuitive measure of overall return, especially useful for understanding the total cash-on-cash return over the life of an investment, without explicitly considering the time value of money or specific discount rates like NPV and IRR do.

Payback Period

The payback period is a simple indicator that shows how quickly an investment pays for itself through generated income or savings. Essentially, it measures how long it takes to recoup the original investment.

Investor Considerations

Carbon investors often prioritize diverse elements beyond primary financial indicators:

Quantity of Carbon Impact (Carbon Yield)

This defines the amount of CO2 equivalent which is reduced or removed per dollar invested.

Quality Benchmark

For carbon investors, the integrity of carbon credits is paramount.

This means seeking projects with robust audits and verification by trusted standards, and demonstrable social and environmental safeguards.

Adherence to integrity principles such as ICVCM's Core Carbon Principles (CCPs) for additionality, permanence, and other quality attributes is crucial.

Impact areas beyond carbon (sometimes referred to as "co-benefits") are highly valued as they bring more attractivity to carbon buyers and can justify premiums.

Time Profile

Investors consider the speed of impact. For example conservation projects often yield faster credits, while reforestation takes longer.

Due to this profile, certain projects offer relatively fast payback period (2-3 years), while others have longer horizons (5-6 years).

Short-term oriented investors may not be fit to support for example mangrove restorations which start yielding after at least 4 years and can have a total lifetime of 30 year.

Investors’ portfolios might balance these different timelines.

Theory of Change

Investors assess how a project aligns with broader impact goals, whether defined internally as part of investor theory, or relating to climate objectives or specific countries or regions.

Local relevance of your project is also an important criteria. For example, early retirement of coal plants is crucial for decarbonization, especially in regions like Asia where 70% of electricity generation is still coal-fired. If these projects can access compliance markets, it could drive significant demand and pricing, making them commercially viable and highly impactful. Investments aligned to such project can make sense because they are aligned to a theory of change supported by strong policy developments.

Revenue Diversification

For certain investors, projects can be increasingly attractive when they can generate revenue streams beyond just carbon credits.

This could include income from commercial products, sustainable crops, agricultural commodities, renewable energy generation, biochar-based fertilizers, or other value-added activities. Especially in food and agriculture, global brands are increasingly looking for solutions to reduce in-value chain impacts.

This opens insetting opportunities for project developers embedded in the supply chain.

Diversified revenue reduces reliance on the volatile carbon market and enhances overall project resilience and investor confidence.

Clear Exit Strategy (for equity investors)

While it can be early, having a well-thought-out idea of how investors can realize their return (e.g., through sale of the project, long-term carbon credit off-take agreements, or eventually a public offering) is important.

Strong Governance Structure

This includes clear decision-making processes, transparent financial management, and a commitment to ethical practices. For larger projects, a well-formed advisory board with industry professionals can be a significant plus.

Innovation and Scalability

Projects that develop a unique innovation or approach can be particularly attractive.

This could involve a novel proprietary carbon sequestration method, a new digital MRV tool, or an innovative community engagement model.

The ability to replicate and export this innovation to other regions or project types signals a high potential for scalability, competitive advantage, and long-term value creation.

Signals that boost investor confidence

Funders are rarely looking for perfection, but they are looking for signals that show you're serious and moving forward. You don't need a full offtake agreement or certified credits to raise capital. But you do need to show progress. The following are example of items well appreciated by investors:

Letters of Intent (LOIs): these documents, even if non-binding, show that other parties are interested in your project's outputs or participation. They act as a strong indication of market interest and potential future demand for your carbon credits.

Feasibility Studies and Draft Project Design Documents (PDDs): completing these foundational analyses demonstrates that you've thoroughly considered the project's viability, methodology, and potential impact. A well-developed draft PDD, even before validation, helps show a clear path towards carbon credit generation.

Early-Stage Grants, Prizes, or Competition Wins: securing non-dilutive funding or recognition through competitive processes serves as powerful external validation. It indicates that your project has been reviewed and deemed promising by reputable organizations or experts.

Partnerships with Trusted MRV or Tech Partners: collaborating with external digital Measurement, Reporting, and Verification (MRV) entities or reputable technology providers lends credibility to your project's technical aspects and data integrity. This signals that you're prioritizing accuracy and transparency in your carbon accounting.

Strong Community Engagement and Benefit Sharing: investors want to see genuine, early, and continuous engagement with local communities, especially when Free, Prior, and Informed Consent (FPIC) is a critical part of a project’s requirements. Transparent and equitable mechanisms for sharing financial and non-financial benefits are paramount to foster community ownership and mitigate social risks.

Partnerships with Reputable Research Institutions: collaborating with established local and international research institutions significantly boosts the scientific rigor of your project's methodology, baselines, and monitoring. These partnerships provide access to specialized expertise, advanced data analysis, and innovative technologies, ensuring accurate carbon measurements, independent validation of impacts, and a commitment to continuous improvement.

Regulatory Alignment and Clearance: project developers should demonstrate that the path to carbon credit generation and international trading is aligned and authorized with the local government. Given the rapidly evolving market frameworks for Article 6, Nationally Determined Contributions (NDCs), and both voluntary and compliance markets, showing that you are up-to-date with policy developments provides crucial confidence to carbon investors. This includes navigating host country authorizations, highlighting possible domestic fees on credits and ensuring the project's framework avoids issues like double counting.

Track Record Credibility: having a demonstrated performance track record and experience from the organization, the founding team, or key members is crucial. This includes direct experience with carbon project certification and development, as well as in related fields such as forestry, agriculture, energy or carbon removal technologies. A history of successfully navigating the complexities of project execution, validation, and credit issuance builds significant trust with investors and signals the team's capability to deliver on the project's promises.

Steps to Get your Project Funding-Ready

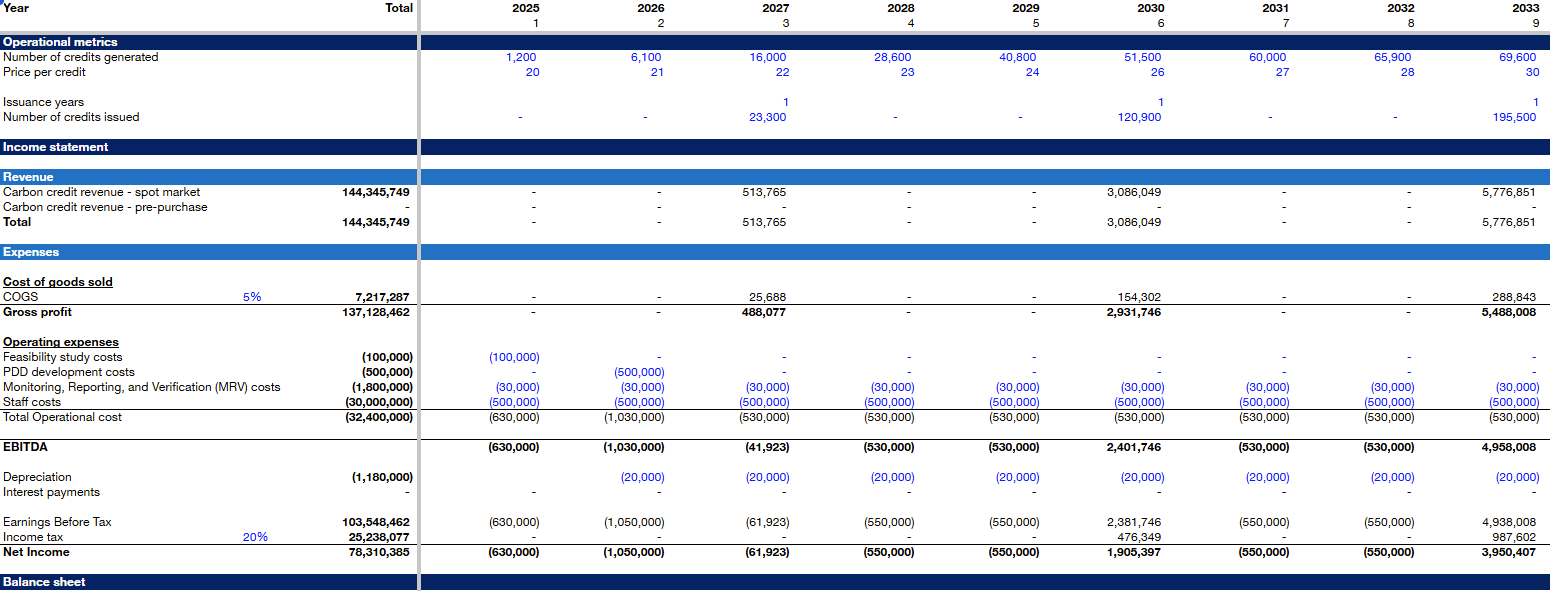

1/ Determine your cost and revenues

Revenues

Start by itemizing all potential sources of revenue. Will your project rely solely on carbon credit revenues, or can you identify additional income streams from other project activities, products or services?

Your projections for carbon credit revenues must be based on clear assumptions regarding the volume of credits you expect to generate, a well-justified pricing strategy, and the timeline for issuance and sale.

Consider reading our second issue of the Carbon Finance Series, on Carbon Pricing.

Costs

Categorize all your project costs into Capital Expenditures (CapEx) and Operational Expenses (OpEx).

CapEx are significant, one-time costs for assets like initial land acquisition or infrastructure.

OpEx are the recurring, day-to-day costs of running the project, such as salaries, maintenance, and monitoring fees.

Crucially, every cost assumption must be justified with strong evidence. This level of detail builds significant confidence and demonstrates your team’s thorough due diligence.

For CapEx, provide equipment quotations, engineering estimates, or comparable project data.

For OpEx, back up your numbers with data on local labor rates, material costs, or historical project spending.

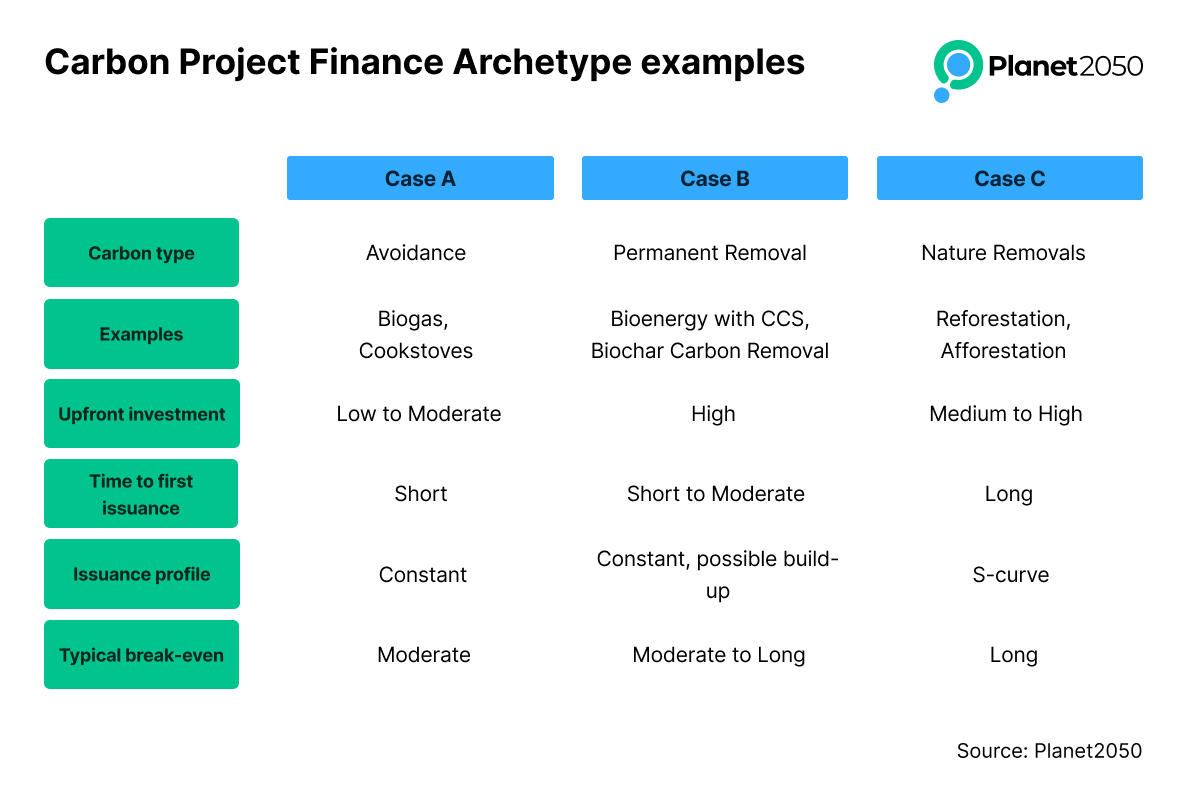

2/ Understand your Project Financial Archetype

Beyond simply listing costs and revenues, it is important to understand the financial archetype of your project.

This refers to the distinct pattern of a project’s cash flows over its entire lifecycle—specifically, the timing, size, and duration of initial investments, ongoing costs, and revenue generation.

Understanding this archetype is crucial as it dictates the type of financing your project needs and the investors you should target.

Different archetypes align with different investor profiles:

Long-lead, high-Capex projects

Such project require substantial upfront capital investment over several years before the first revenues from carbon credits can be realized.

They are best suited for patient, long-term capital from sources like private equity, development finance institutions, family offices or institutional investors such as pension funds who are comfortable with a delayed payback period.

Lower-Capex, shorter-yield projects

Other projects with different archetypes may require lower initial capex capable of yielding early-on in the project lifetime, often within the first 1-2 years.

These projects may be attractive to a broader range of investors, including venture capital and project finance providers, as they offer a quicker path to cash flow and can service debt sooner.

3/ Develop a Detailed Financial Plan

The model should be a detailed, multi-year projection that includes your identified costs and revenues. To make it easy to understand and edit, set all of your assumptions—such as discount rates, carbon credit prices, and project development timelines.

Set all parameters in a separate, clearly labeled section to help investors quickly grasp your core assumptions and test how changes might affect the project's profitability.

Need a way to start? Watch the recording and materials provided in a recent Gold Standard Masterclass on Carbon Finance organized led by CrossBoundary:

An important part of this plan is scenario analysis. You should develop several scenarios to test your project's financial resilience against key parameter changes such as market volatility. Instead of just one optimistic projection, create at least three distinct models such as a base case, a conservative and an ambitious scenario.

This will show that you have a comprehensive understanding of the risks and opportunities, and that you're prepared for different market conditions. This builds credibility and positions your project as a well-thought-out, resilient investment.

4/ Assemble Your Investor-Ready Documentation

To instill confidence in potential funders, your project must be backed by a comprehensive and professionally organized set of documents.

This preparation is a non-negotiable step that demonstrates your project’s integrity and meticulous planning.

This will include key documents, depending on your project stages, such as

Project Design Document (PDD), Feasibility Studies, Technico-

Detailed Financial Model

Pitch Deck

Business Plan / Executive Summary

Existing agreements (LOI, Land titles, Offtakes..)

Organizational structure

Team biographies

Finally, ensure all documents are clear, well-designed, and easily accessible. Organize them in a proper, easy-to-navigate digital data room to streamline the due diligence process and signal professionalism.

Source: GoldStandard Finance Masterclass by CrossBoundary

5/ Pressure-Test Your Project for Investor Readiness

Before you approach investors, you must critically evaluate your project through their eyes. Answering these key questions thoroughly will refine your pitch, demonstrate strategic foresight, and prepare you for rigorous due diligence.

Project roadmap: what does your full project lifecycle look like, from initiation to long-term scaling? What is your vision for it to grow?

Unique value proposition: what gives your project a competitive advantage? What makes it different?

Partnership needs: beyond capital, what strategic support—like network or expertise—do you require from a funder?

Risk analysis: what are the major risks (technical, market, regulatory, social) and your mitigation strategies?

Market Demand: have you demonstrated market interest through pre-sales, Letters of Intent, or other agreements?

Investor Profile: what type of funder aligns with your mission and values, and who do you want to avoid?

These questions don't just prepare you, they also shape your ask and signal maturity to the funders.

Speaking of coming prepared...

6/ Telling the Right Story. Your story!

It's easy to get lost in the technical weeds of methodology and financial projections.

While these details are essential, they are not the full story. Investors are ultimately people who are betting on your team, your vision, and your ability to execute.

A great story shows the passion behind your project and highlights why your team is the right one to see it through to success.

Planet2050’s role in Carbon Financing

Planet2050 provides early capital to project developers in exchange for future carbon credits — using a combination of instruments of equity investment, carbon streaming agreements and forward contracts.

Through upfront financing, technical expertise, and close engagement with project developers, Planet2050 is building a high-quality portfolio — and a new infrastructure for the climate economy.

Project developers can contact us or directly apply through the Project Onboarding Form to submit their project for assessment.

Opportunities for a new Generation of climate investors

For investors, this creates exposure to a new climate-linked asset class with long-term growth potential.

Planet2050 plans to make these investments accessible beyond traditional private finance, to a wider public, through an upcoming public listing in Europe.

Learn more at https://planet2050.earth/investors

__________________

Three-Part Carbon Finance Serie

The was Part #3 of our three-part Carbon Finance Series. Check out Part #1 on Carbon Project Financing and Part #2 on Carbon Pricing.

You can also subscribe to Planet2050 at https://planet2050.earth/newsletter